Non-real estate farm lending activity at commercial banks picked up slightly in the first quarter of 2024 alongside an increase in the average size of operating loans. According to the Survey of Terms of Lending to Farmers, the volume of new non-real estate farm loans was about 2% higher than a year ago and farm operating loan volumes increased more than 10%.

The uptick in operating loans likely reflects increased financing needs arising from lower commodity prices, high input costs, and softening farm income. Loan volumes grew despite a smaller number of loans reported in the survey, suggesting that financing needs may be concentrated in operations with smaller cash buffers or those that want to preserve working capital.

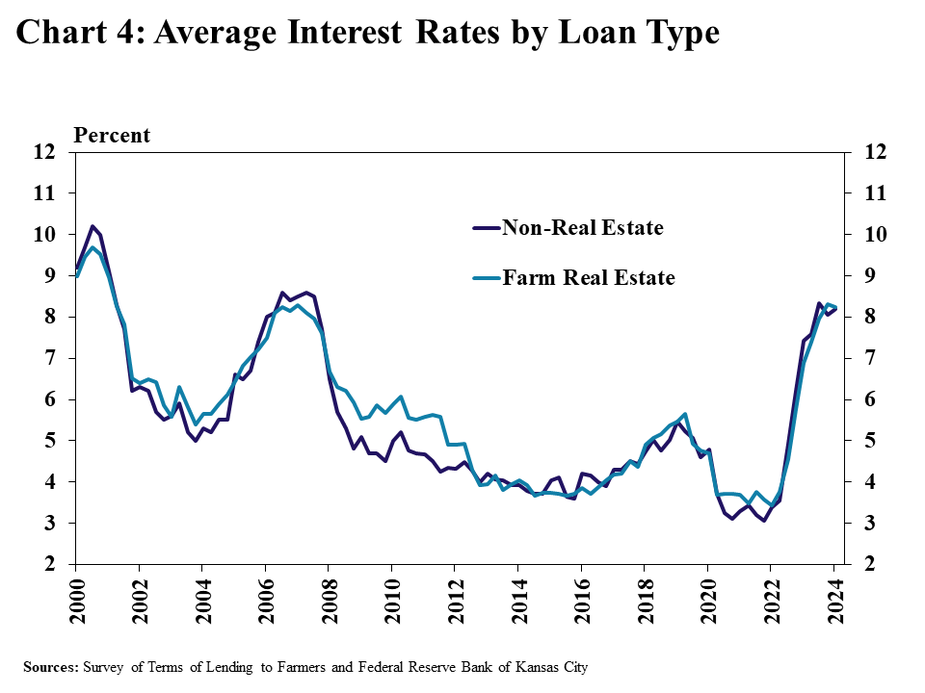

Despite growth in non-real estate loans, average interest rates on agricultural loans remained relatively high. For crop producers, increased financing costs could dampen profitability this year and may be particularly challenging for highly leveraged borrowers. In the cattle industry, higher interest expenses could also limit profits and put a dent on cattle herd rebuilding.

First Quarter National Survey of Terms of Lending to Farmers

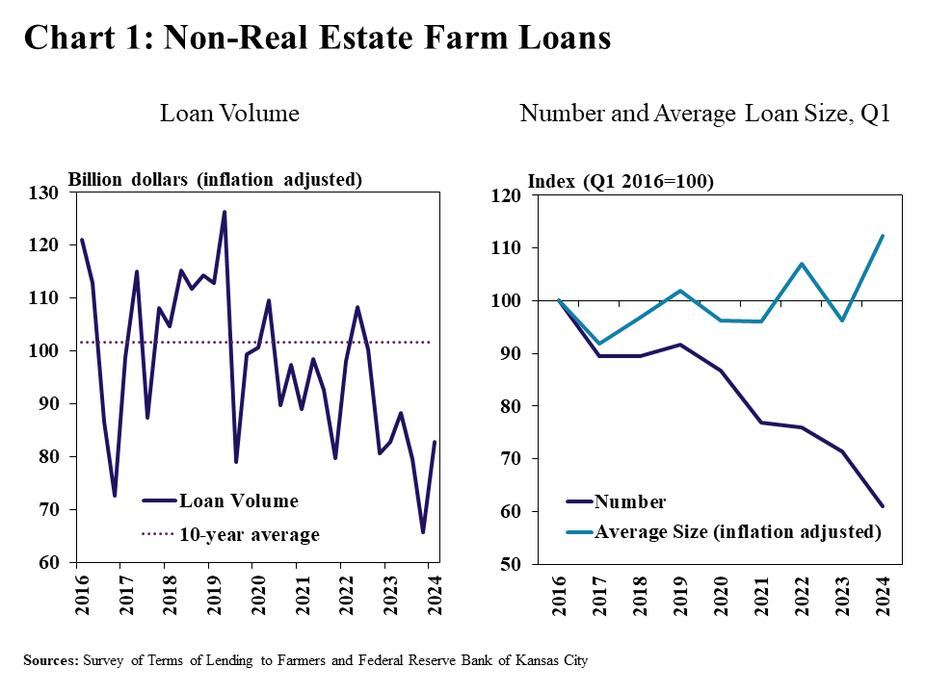

Larger average loan sizes boosted non-real estate lending in the first quarter of the year. Loan volumes increased substantially for the first time since 2022, but remained below the average volume of the last decade (Chart 1, left panel). Larger loan sizes more than offset the smaller number of loans distributed in the first quarter of 2024, boosting the volume of non-real estate loans (Chart 1, right panel).

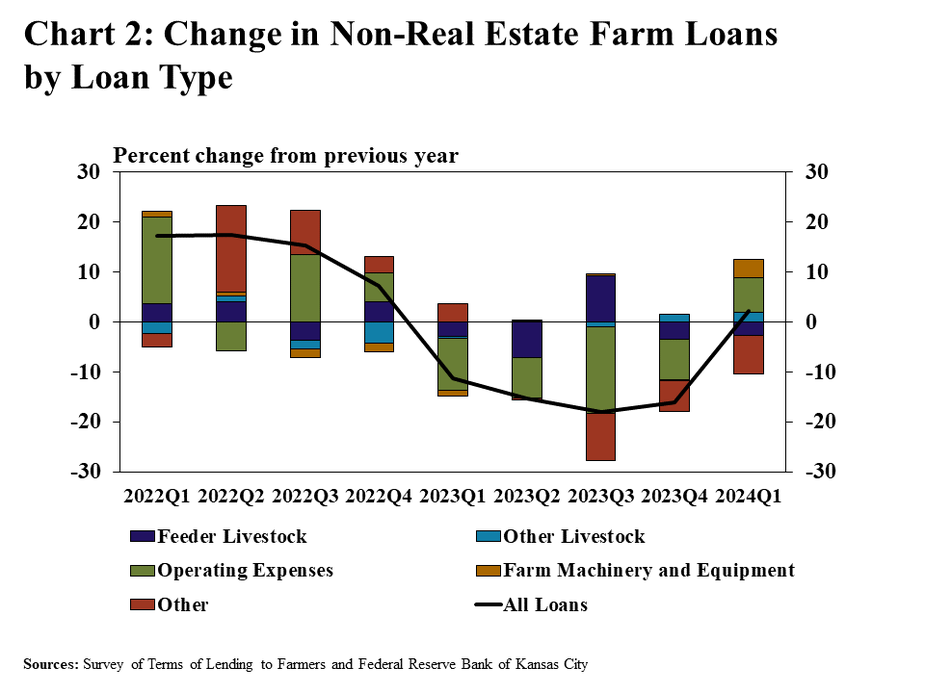

A large portion of the increase in lending activity was attributed to operating loans. The growth in operating loans in the first quarter of the year staunched the trend of reduced loan volumes reported in 2023 (Chart 2). Loans used to finance operating expenses, farm machinery and equipment brought the volume of non-real estate loans slightly above the levels observed in the first quarter of the previous year.

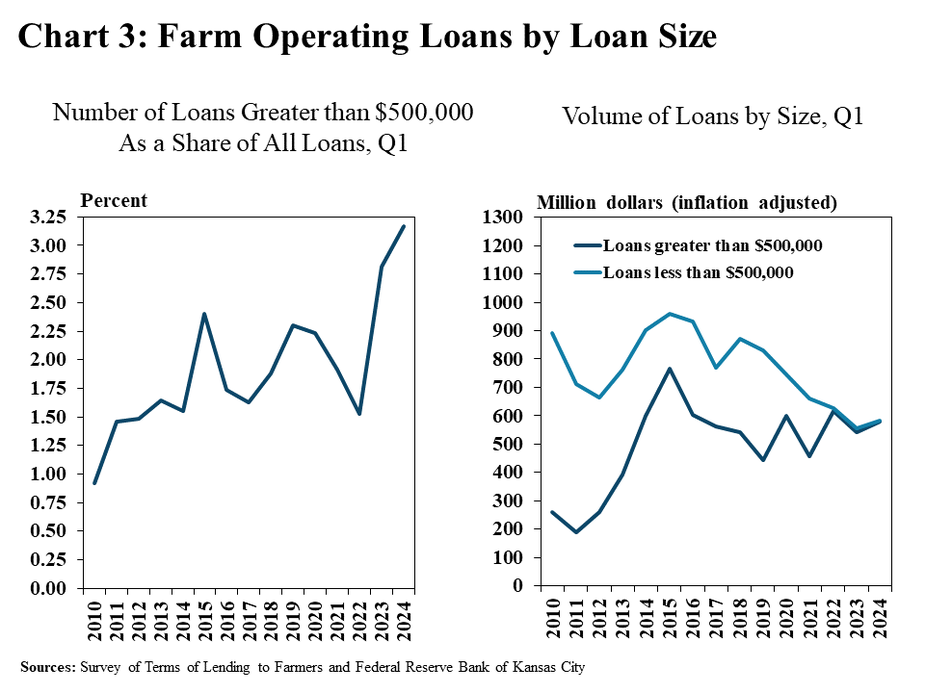

Operating loan volumes grew alongside an increase in large loans. The share of new loans larger than $500,000 was considerably higher than recent years, rising to more than 3% in the first quarter (Chart 3, left panel). In fact, roughly half of all lending activity was attributed to loans larger than $500,000, a trend that has persisted since 2022 (Chart 3, right panel).

Lending activity increased as average interest rates on farm loans steadied along with benchmark rates. The average rate charged on all types of farm loans was mostly unchanged from the previous quarter (Chart 4). Farm loan interest rates climbed rapidly in 2023, but have steadied as the federal funds rate has stayed unchanged in recent months.

Data and Information

Excel SpreadsheetNational Survey of Terms of Lending to Farmers Historical Data

Excel SpreadsheetNational Survey of Terms of Lending to Farmers Tables

txtAbout the National Survey of Terms of Lending to Farmers

The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.