Housing contributes to the overall well-being of residents in a variety of ways, providing individuals with shelter and safety, being a source of amenities that add to the quality of one’s livelihood, and even serving as a substitute office for those working from home. Due in part to the importance of these attributes, several public policies have been aimed at promoting housing security for residents amid the COVID-19 pandemic. These policies range from federal programs that allow residents to defer payments or enter forbearance on certain home mortgages, to local programs that subsidize housing expenditures.i Support also has come through the financial system as the Federal Reserve and other regulators have encouraged lenders to be flexible with borrowers who are facing acute challenges due to the pandemic.ii These programs were rolled out amid a rapid rise in joblessness that occurred as the nation attempted to slow the spread of the virus, which also potentially impaired the ability of households to make mortgage or rent payments.

Compared with the sharp rise in unemployment rates and sudden slowdown in overall economic activity, the number of U.S. households reporting they were unable to make recent housing payments has risen modestly. Households in the Rocky Mountain region generally have had fewer missed payments than the national average. However, one in five homeowners in the region and one-quarter of renters indicated that they used economic stimulus payments or unemployment insurance benefits to help meet their housing expenses in June. While a smaller share of households in Colorado, New Mexico and Wyoming have relied on these programs as compared with the rest of the country, the ability of households to meet their housing expenses warrants ongoing monitoring.

Financial Conditions of Rocky Mountain Households Prior to the Pandemic

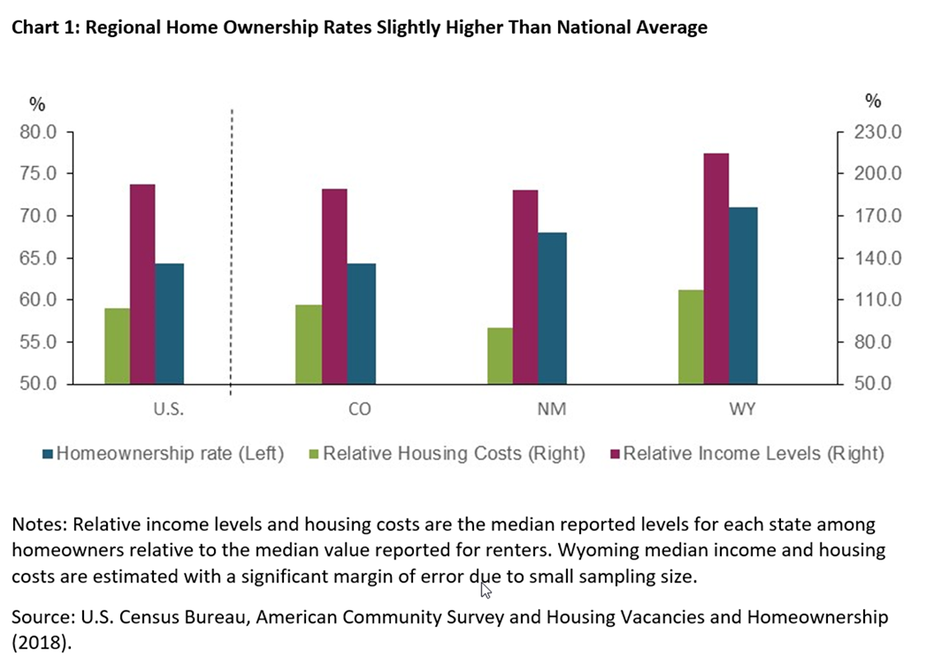

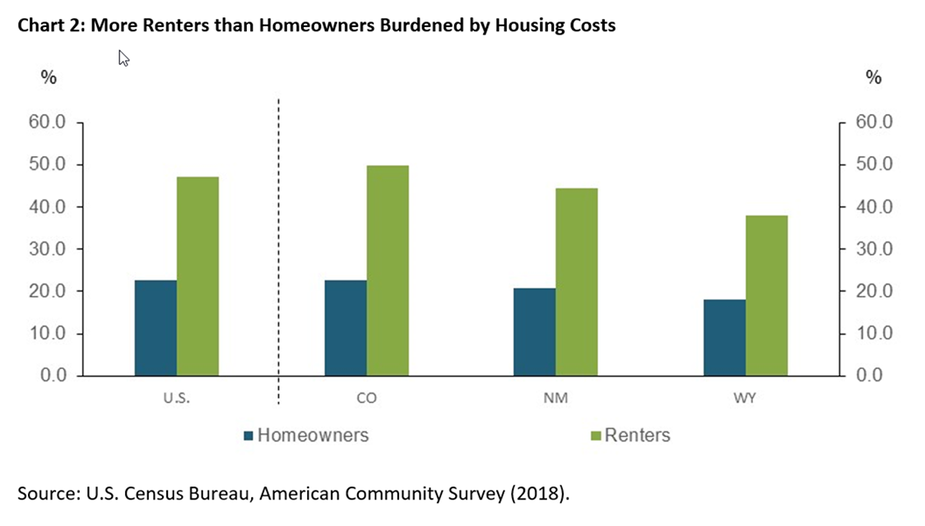

Across the United States, about two-thirds of adults live in homes they own, with households in Colorado, New Mexico and Wyoming at least as likely to own their homes. Prior to the pandemic, renters and homeowners exhibited sharp differences in financial conditions, according to the U.S. Census Bureau’s American Community Survey. Household income among typical homeowners throughout the region is roughly 90 percent higher than the median income of renters (red bars, Chart 1). However, the typical monthly housing expenses among renters and homeowners differ only modestly (green bars). A consequence of these disparities is that nearly half of renters in Colorado and New Mexico are classified as being burdened by housing costs, spending in excess of 30% of their total household income on housing (Chart 2). In comparison, less than a quarter of homeowners spend more than 30% of their income on housing each month.

Financial Conditions of Rocky Mountain Households at the onset of the Pandemic

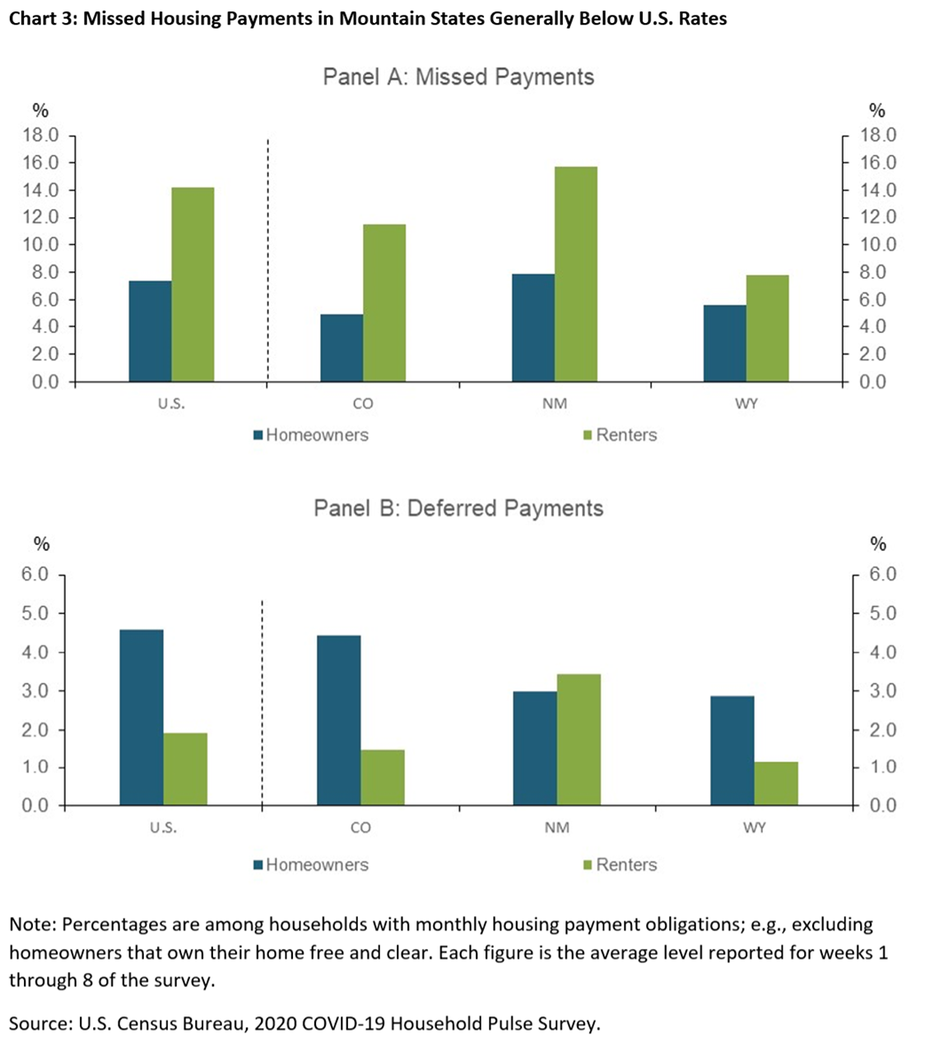

In the weeks following the implementation of shelter-in-place efforts and an unprecedented rise in unemployment rates nationwide, some residents either deferred or missed housing payments, with parts of the Rocky Mountain region faring somewhat better than the country as a whole. Pulse surveys conducted by the U.S. Census Bureau measured responses to the pandemic through June, showing that the share of homeowners in Colorado and Wyoming that did not make their most recent mortgage payment was below the national average of 7.4% (blue bars, Chart 3). In contrast, about 8% of homeowners in New Mexico did not make their most recent payment, exceeding the national average through the middle of June.

Differences in the initial financial conditions between homeowners and renters also are reflected in the rate of missed payments following the onset of the pandemic. Again, the share of renters that missed payments in June was below the national average in Colorado and Wyoming, but higher in New Mexico. Yet, compared with homeowners, the share of households that missed payments was substantially higher among renters both across the region and the country. For example, into the last weeks of June nearly 12% of Colorado renters reported missing their most recent payment, alongside the 14% of U.S. renters that missed a payment (green bars, Chart 3, Panel A). Generally, homeowners are about half as likely to have missed a housing payment across the Rocky Mountain region.

Some households have sought to defer rather than miss a housing payment, though the share of homeowners throughout the three-state region that deferred their mortgage payment generally is below the national average. About 4.5% of Colorado residents reported deferring their mortgage payments in June, 1-2 percentage points more than homeowners in New Mexico and Wyoming (blue bars, Chart 3, Panel B). A much smaller share of renters nationwide reported deferring their housing costs compared with homeowners (green bars), and in Colorado and Wyoming the share of renters who reported deferring their payments was smaller than the national average. While survey responses indicate the actions households took regarding housing payments, they may not reflect the opportunities available to residents to seek or obtain a deferral. Regardless of why housing payments were not met in recent months, either deferred or missed, Chart 3 shows that New Mexico residents were more likely to have not made recent housing payments than the rest of the country, while Colorado and Wyoming residents fared somewhat better.

Compared with the profound increase in joblessness during the second quarter of 2020, the rise in the number of missed housing payments initially appears relatively modest. Indeed, labor markets had been strong going into the pandemic. Savings rates had picked up. Wages were growing, and growing at the fastest rates among low-skill workers. These strong fundamentals could have supported households in making payments the first months following the downturn in economic conditions due to the pandemic. However, the Federal Reserve’s Survey of Household Economics and Decisionmaking for the end of 2019 reported that more than a third of households have insufficient funds to meet a $400 emergency expense. These contrasting perspectives on household financial conditions highlight the need to look closely at the sources of income that have supported housing payments in recent months.

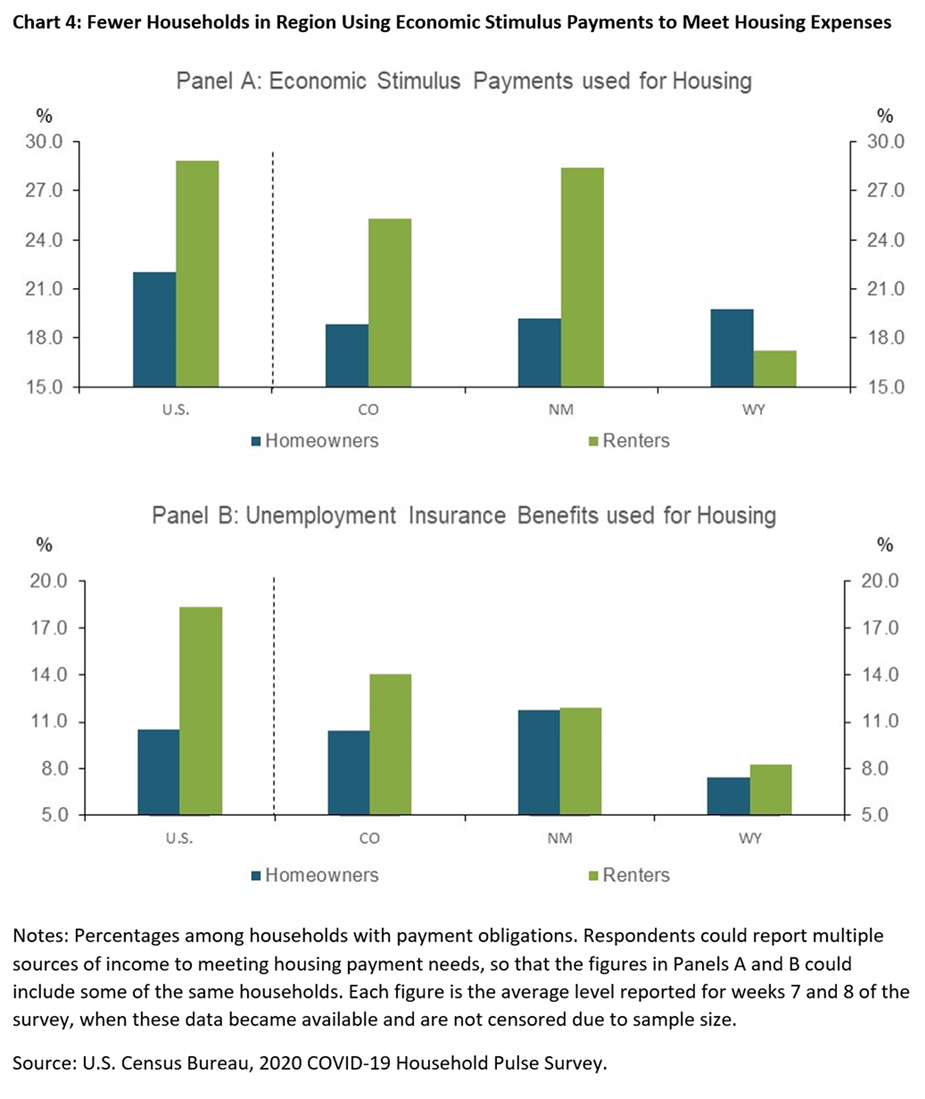

Nearly one in five homeowners in the Rocky Mountain region reported using economic stimulus payments from the CARES Act to make their mortgage payment. For renters in the region, nearly a quarter relied on stimulus payments, at least in part (Chart 4, Panel A). Besides the stimulus payments, about 10% of households in the region used money from unemployment insurance benefits to meet their most recent housing expenses (Panel B). Note that households could have used a combination of these sources; the numbers in Panels A and B should not be added together to gauge total reliance on subsidized benefits. Regardless, these facts indicate that a key reason that households generally have been successful in making their housing payments is the support that comes from federal programs or jobless benefits, in addition to other sources of household savings and income.

While a sizable portion of the Rocky Mountain region used stimulus payments or jobless benefits to make housing payments, nationwide a much larger share of U.S. households relied on these sources of income in recent weeks. Nearly 30% of U.S. renters and 22% of U.S. homeowners reported having used stimulus payments for housing, exceeding figures for the region (Chart 4).

Household Demographics and Housing Expenses

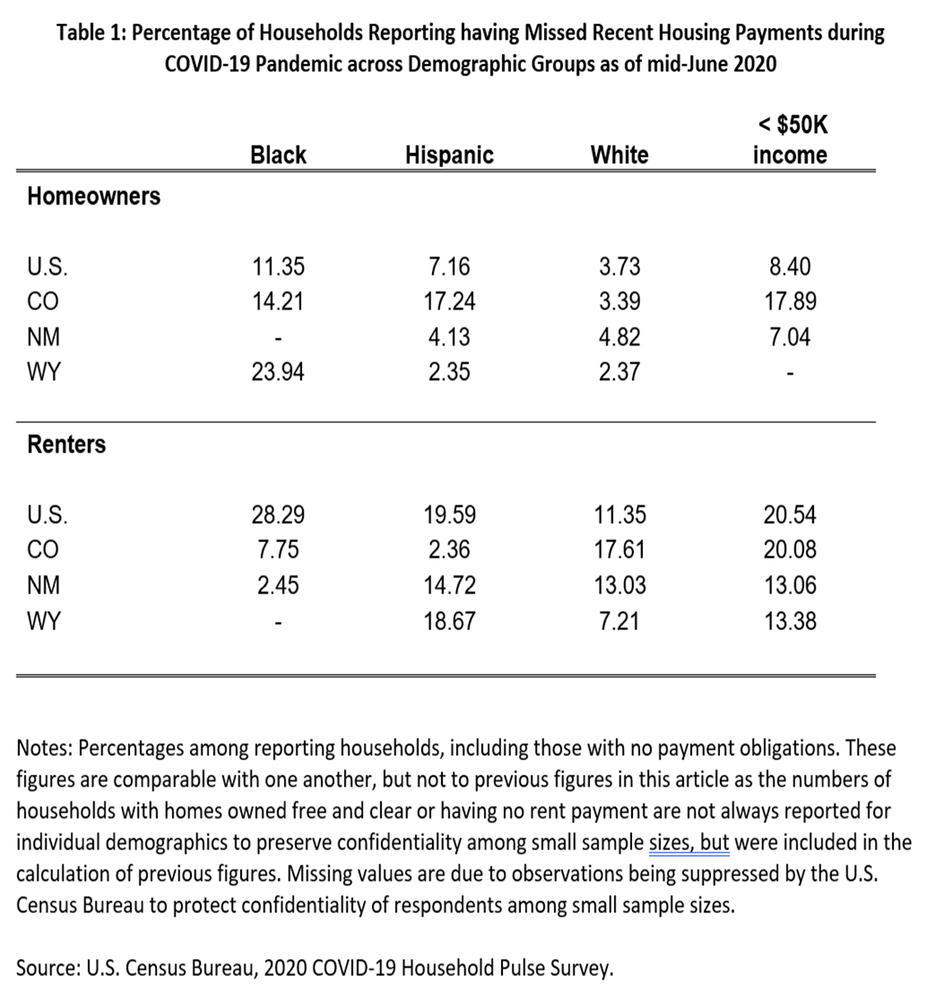

Financial conditions within the region differ from the rest of the nation, but also among households with different demographic backgrounds. Likewise, the COVID pandemic has had disproportionate effects on certain household demographics and initial homeownership rates differ according to race, the income levels of household members and exposure to financial distress.iii Recognizing these differences, Table 1 reports the rates of missed payments among different households reported in the U.S. Census Bureau 2020 COVID-19 Household Pulse Survey. Because of the breakdown of reporting households by their characteristics, many of the sample sizes become smaller and are therefore suppressed to maintain confidentiality. As a result, the figures in Table 1 indicate the number of missed payments among all reporting households, not accounting for those that do not have a mortgage payment or rent payment required. Thus, the figures in Table 1 should not be compared with those above that look across all households, but still are useful in gauging the relative rates of missed housing payments across demographic groups.

The last column of Table 1 shows that low- to moderate-income households, in these figures defined as those with less than $50,000 annual income, were much more likely to have missed a recent mortgage payment in Colorado relative to the rest of the country through mid-June. In fact, lower-income homeowners in Colorado were more than twice as likely to have missed their mortgage payment compared with the U.S. average of about 8.4%. However, low-income renters and homeowners in Colorado were about just as likely to have missed a recent housing payment. Within the group of households earning less than $50,000, the distinction between renters and homeowners is less of a determining factor in meeting housing expenses than it is for higher income households.

The first three columns of Table 1 highlight stark disparities across households that report consisting of individuals from different races. Black homeowners in each Rocky Mountain state have higher rates of missed or deferred payments than white homeowners. However, the same is not true for Black renters, who are less likely to have missed recent rent payments during the pandemic. Hispanic homeowners in Colorado likewise are more likely to have reported missing a recent payment than white households, but Hispanic renters have been relatively less likely to have missed rent payments.

Looking Forward

The health, financial and economic conditions throughout the Rocky Mountain region remain dynamic. Households in the region generally have been able to meet their housing expenses through the initial weeks of the pandemic, in part because of support from temporary stimulus payments or jobless benefits. Recent reports show some improvements in the labor market that will support household income and several indicators point to healthy levels of real estate activity. Yet, unemployment throughout Colorado, New Mexico and Wyoming and the uncertainty around the contagion of COVID-19 both remain elevated. All of these factors together imply that the evolving conditions for housing markets should continue to be monitored in coming months.

References

• “Agencies encourage financial institutions to meet financial needs of customers and members affected by coronavirus,” joint press release dated March 9, 2020 (External Linklink)

• “Report on the Economic Well-Being of U.S. Households in 2019,” Federal Reserve Board, May 2020 (External Linklink)

• “How will COVID-19 Affect Financial Assets, Delinquency and Bankruptcy?” Sánchez, J., Ryan Mather, R., Athreya, K., and Mustre-del-Río, J., Federal Reserve Bank of St. Louis, May 2020 (External Linklink)

• “Homeownership and the American Dream,” Goodman, L and Mayer, C., Journal of Economic Perspectives 32(1), Winter 2018, pp 31–58

Endnotes

i. E.G., from the CARES Act and the guidance from government-supported enterprises, the Federal Housing Administration, U.S. departments of Veterans Affairs and Agriculture, homeowners facing financial hardship due to the pandemic have the right to request and obtain forbearance on mortgage payments for 180 days, and also to seek an extension for up to another 180 days (for a total of up to 360 days).

ii. Federal financial institution regulators and state regulators encouraged financial institutions to meet the financial needs of customers and members affected by the coronavirus. Regulators noted that financial institutions should work constructively with borrowers and other customers in affected communities. Prudent efforts that are consistent with safe and sound lending practices should not be subject to examiner criticism. See the jExternal Linkoint press release from regulatory agencies dated March 9, 2020.

iii. See, for example, Sanchez et al. (2020) and Goodman and Mayer (2018).