China’s real estate sector has undergone rapid growth over the last two decades. Real estate investment grew at about a 20 percent average annual rate from 1999 to 2018, more than twice the rate of GDP growth over the same period. The strong growth in housing activity was driven by two sources of strong demand. The first source was the housing reform in China in the late 1990s, which gradually moved Chinese households from public housing to private housing, generating huge housing demand (called “rigid demand” or “gang xu” in Chinese). The second source was fast growth in house prices combined with a lack of other financial investment opportunities, which spurred enormous speculative demand in the Chinese housing market.

However, demand from both sources has weakened recently. By 2013, about 20 percent of Chinese households already owned multiple houses._ Additionally, the share of Chinese young people age 20 to 29, the main source of new demand for housing, started to decline in 2014. Furthermore, the Chinese government has tightened control on speculative investment in the housing market since 2017 amid growing concerns that high house prices are pushing up the costs of doing business and restricting consumer spending. The recent intense debate in China on introducing a property tax has put further downward pressure on the Chinese housing market.

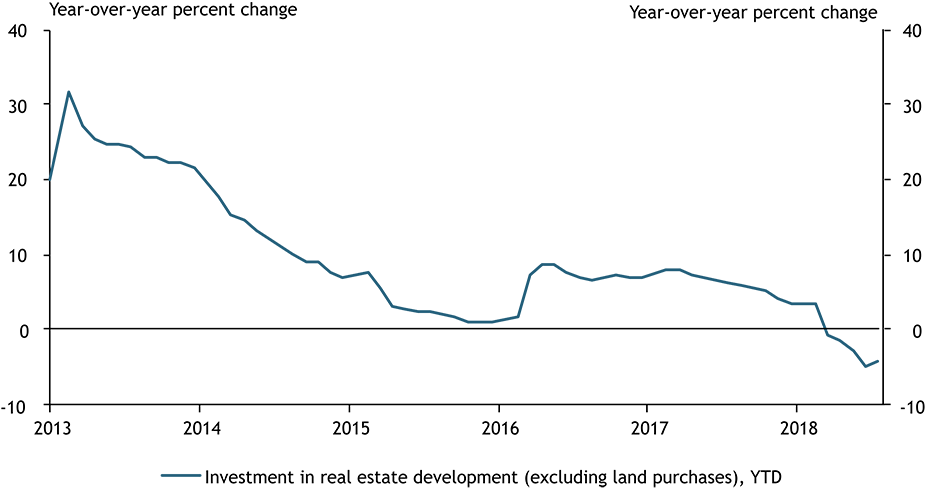

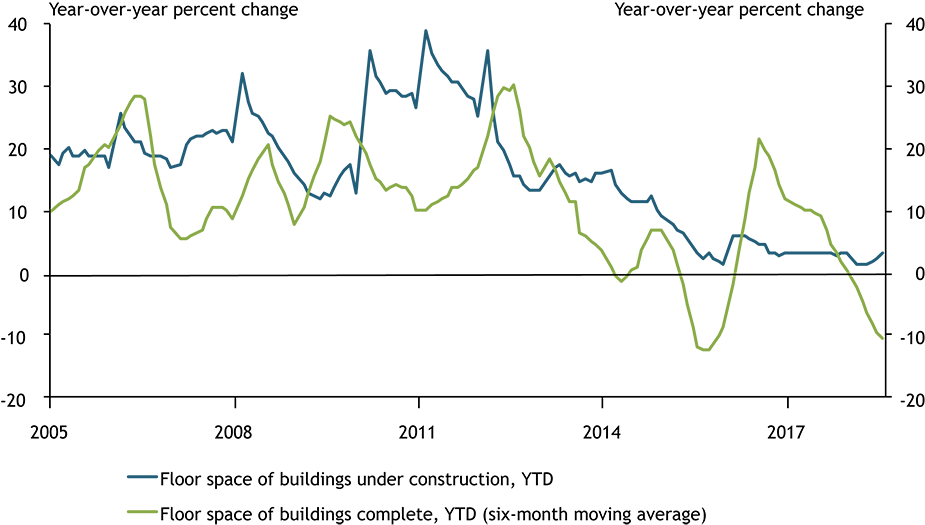

In response to this weakening demand, year-over-year investment growth in real estate development excluding land purchases—a measure that focuses on real estate construction, installation, and equipment purchases—has dropped by more than 10 percentage points from about 8 percent in the middle of 2017 to −4 percent in July 2018 (Chart 1). In addition, housing construction, measured by growth in the floor space of buildings under construction, has dropped from a double-digit pace to a pace close to zero, while growth in the floor space of completed buildings has turned negative (Chart 2).

Chart 1: Growth in Real Estate Investment (Excluding Land Purchases)

Source: Wind Information Company, Ltd.

Chart 2: Growth in Construction Activity

Source: Wind Information Company, Ltd.

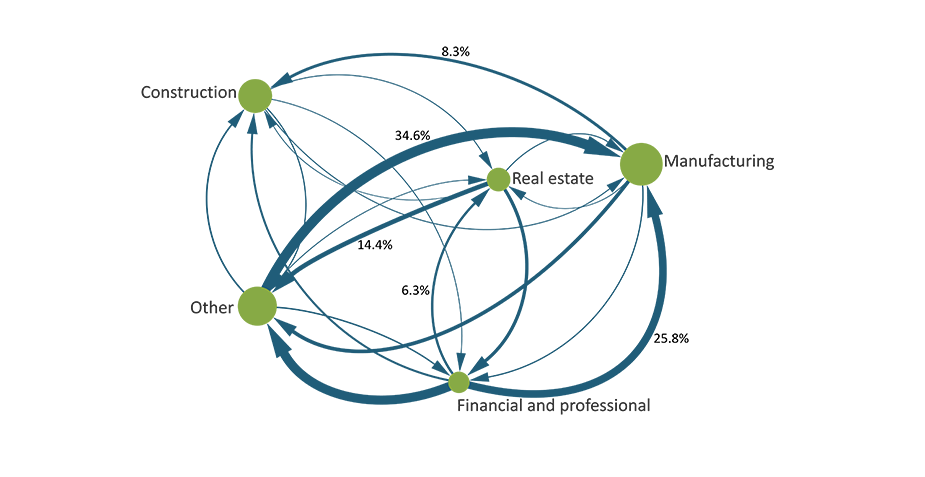

With shrinking demand and an oversupply of houses, housing activity is likely to slow further in the longer run. How, then, will China’s GDP respond? To answer this question, we examine how different industries are connected to housing activity using an input-output (IO) table, which reports a given industry’s total output as well as how much of other industries’ output it uses.

Chart 3 illustrates connections between industries based on a simplified version of China’s IO table in 2012 (the latest version available). For the purpose of illustration, we group 139 industries into five sectors: construction, real estate, manufacturing, financial and professional, and other. Housing activity is reflected in both the real estate sector and the construction sector._ The relative size of each node (green dot) shows the relative size of total output in each sector. The arrows on the blue lines indicate the direction of the flow of output from one sector to another, and the width of the lines shows the relative size of that output. For example, the thin line connecting the manufacturing sector to the construction sector shows that the construction sector used 8.3 percent of the manufacturing sector’s output in 2012. In comparison, the thick line connecting the “other” sector to the manufacturing sector shows that the manufacturing sector used 34.6 percent of output in other sectors. Together, these connections suggest that an exogenous decline in construction activity, for example, may lower demand for the manufacturing sector, which, in turn, may cause demand for other sectors to decline.

Chart 3: A Simplified Version of China’s Input-Output Table in 2012

Sources: National Bureau of Statistics of China and authors’ calculations.

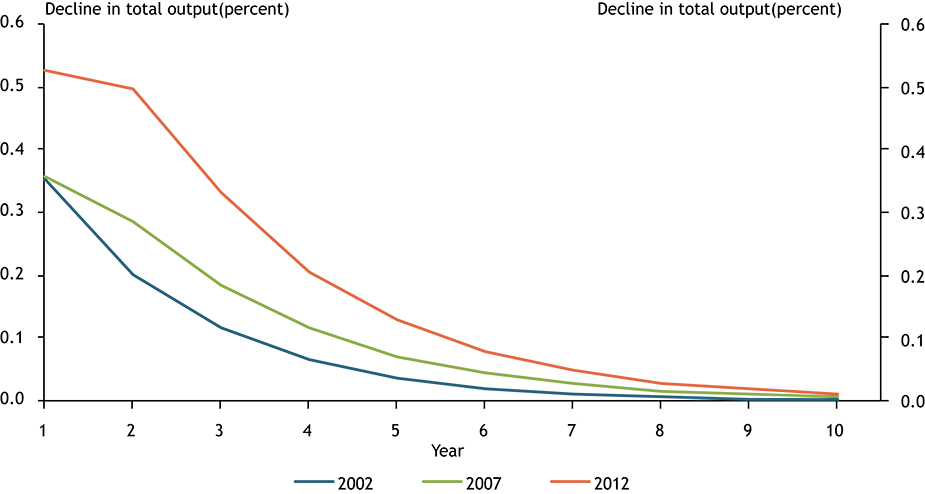

To estimate the effect of a decline in housing activity on total output, we follow Cook, Nie, and Smalter Hall (forthcoming) and estimate the response of all industries using IO tables. In particular, we map values from an IO table into a system of linear equations and use them to compute the dynamics in all variables due to changes to variables related to housing activity._ Chart 4 shows the effect of a 10 percent decline in housing activity on China’s total output over a 10-year horizon._ The blue line is calculated using the most recent IO table in 2012, and the green and gray lines are calculated using IO tables in 2007 and 2002, respectively. The chart reveals two major findings. First, the negative effect on China’s total output is quite persistent and dissipates gradually after 10 years. Second, the effect has become much larger in more recent years, suggesting that the housing market has become more important to China’s economic growth over time.

Chart 4: Response of Total Output Following a 10 Percent Decline in Housing Activity

Sources: National Bureau of Statistics of China and authors’ calculations.

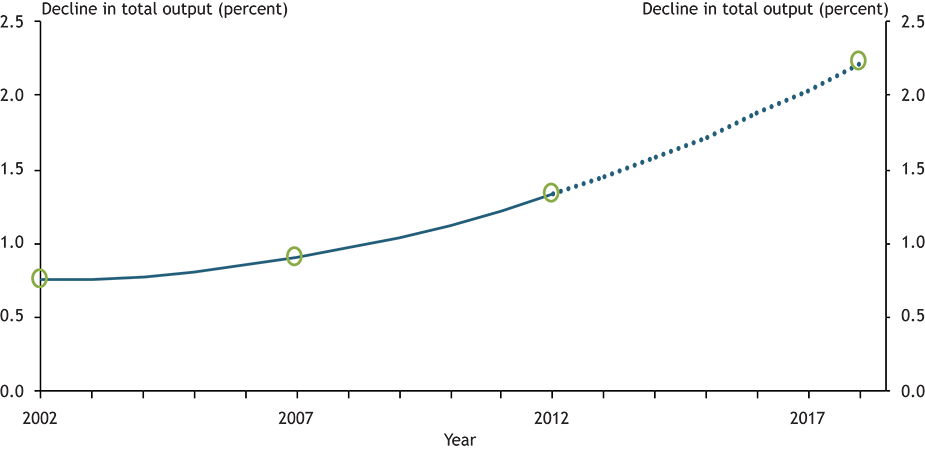

Chart 5 shows the growing effect of the housing sector by summing the yearly estimates from the three IO tables in Chart 4. Each green circle in the chart shows the total effect of a 10 percent decline in housing activity on China’s total output based on interindustry relationships within a given year. For example, the green circle for 2012 shows the total effect as 1.33 percent, suggesting the accumulated decline in China’s total output over the next 10 years would be around 1.33 percent of the current year’s output. A polynomial function that fits all three estimates suggests that by 2018, the total effect could increase to 2.2 percent. In other words, our analysis suggests that if current housing activity declines by 10 percent, the total decline in China’s output over the next few years could be around 2.2 percent of 2018 GDP.

Chart 5: Total Effects of a 10 Percent Decline in Housing Activity

Sources: National Bureau of Statistics of China and authors’ calculations.

Finally, it is important to note that the above estimate assumes a 10 percent decline in housing activity. In reality, the size of the decline will depend on the extent to which the Chinese government acts to stabilize the housing market. Historically, the government has often intervened in the housing market. For example, in response to declines in house prices in 2014, local governments loosened restrictions on home purchases, and the central bank lowered mortgage rates for second-home buyers. In addition, the government-sponsored Shantytown Renovation Program, which offered cash compensation to residents whose homes were demolished, supported home prices in small cities in the last two years, largely explaining why the growth of house prices in these cities has not slowed as much as in big cities in China. Although Chinese authorities have recently attempted to cool the housing market, they are likely to reverse these policies and institute new interventions if the housing market becomes a significant drag on the Chinese economy.

Endnotes

-

1

According to the Survey and Research Center for China Household Finance, the vacancy rate of sold residential homes in urban areas reached 22.4 percent in 2013.

-

2

In a typical IO table for China, the construction sector includes real estate construction. However, the IO table does not explicitly separate real estate construction from other types of construction. In the analysis, we assume all investment in real estate development excluding land purchases turns into fixed capital, and thus use the share of fixed capital formation related to the real estate sector in total fixed capital formation in the construction sector to approximate for the share of housing-related construction in total construction

-

3

Miller and Blair (2009) provide an excellent review of input-output models.

-

4

In general, we can write an IO table in the form of x = Z*i + f, where x (a vector) refers to output from different industries, Z shows the input from one industry to other industries, i refers to the total intermediate input from different industries, and f is the final demand representing demand from consumers, governments, and foreign investors. In this exercise, we assume final demand (the components in f related to real estate and part of construction) declines by 10 percent. The shares of construction we estimate to be related to real estate construction are 46.3 percent, 34.7 percent, and 23.3 percent in 2012, 2007, and 2002, respectively.

References

Cook, Thomas, Jun Nie, and Aaron Smalter Hall. Forthcoming. “An Inter-industry Analysis of China's Housing Market and the Macroeconomy.” Federal Reserve Bank of Kansas City, Research Working Paper.

Miller, Ronald E., and Peter D. Blair. 2009. Input-Output Analysis: Foundations and Extensions, second edition. Cambridge: Cambridge University Press.

Thomas Cook is a data scientist, Jun Nie is a senior economist, and Aaron Smalter Hall is a senior data scientist at the Federal Reserve Bank of Kansas City. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.