The Federal Reserve began tightening monetary policy in March 2022 to combat higher inflation. This tightening, in turn, increased borrowing costs for a wide range of consumer financial products such as auto loans, mortgages, and credit cards. Higher borrowing costs can dampen demand as households use more disposable income to service interest expenses, which, in turn, can cool inflation.

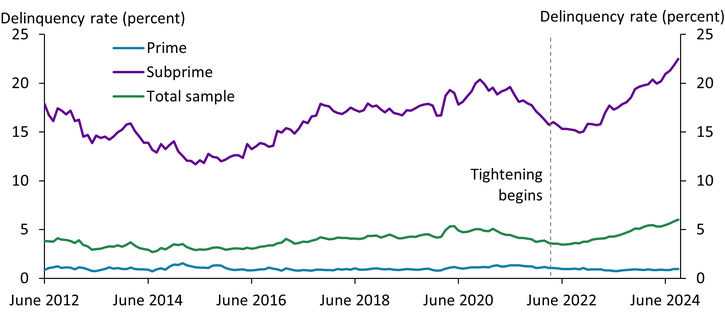

Despite the large, sustained increase in interest rates over the last couple of years, consumer finances show only moderate signs of stress. Chart 1 shows that as of September 2024, credit card delinquency rates have not risen for prime borrowers (blue line) since policy tightening began. Although delinquency rates have risen for subprime borrowers by 5.6 percentage points over the same period, these borrowers make up only 23 percent of the total consumer credit market.

Chart 1: Credit card delinquency rates for prime borrowers have not risen during the recent tightening cycle

Note: Rates are weighted by outstanding credit card balance.

Source: Board of Governors of the Federal Reserve System.

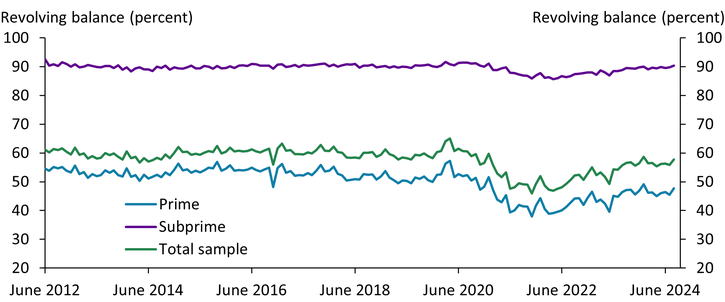

Delinquency rates are indeed a critical tool for assessing the financial health of households and banks, but the underlying payment behavior of credit card users may provide additional information. Revolving balances, for example, measure the percentage of credit card balances that are rolled into the following pay period and thus carry interest. Higher revolving balances indicate increased stress and can be a harbinger for future delinquency. Chart 2 shows that revolving balances for both prime and subprime borrowers remain below their pre-pandemic levels. Stable revolving balances suggest households are not rolling over additional credit card debt and are thus better able to pay off balances.

Chart 2: Revolving balances remain below pre-pandemic levels

Notes: Revolving balances are measured as a percentage of the last billing cycle balance. Chart shows weighted averages.

Source: Board of Governors of the Federal Reserve System.

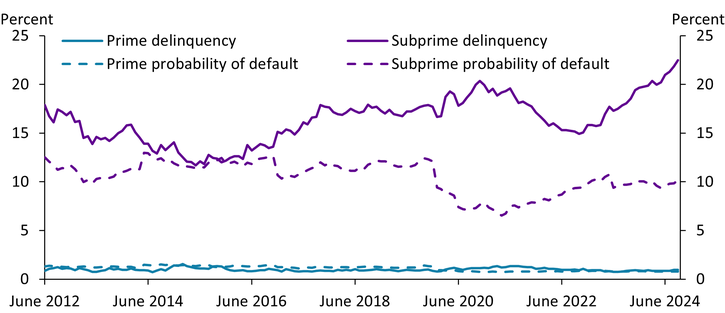

In addition, internal bank assessments suggest that the probability of default among subprime borrowers remains at historically low levels, despite the increase in delinquency rates._ Chart 3 shows that bank forecasts for subprime default (dashed purple line) have remained stable since the first quarter of 2023, suggesting banks see few signs of credit deterioration and charge-offs that would eat into their earnings and capital._

Chart 3: Bank default forecasts have stabilized, suggesting delinquencies may plateau

Notes: Dashed lines represent bank default forecasts while solid lines represent delinquency rates. Data are weighted by outstanding credit card balance.

Source: Board of Governors of the Federal Reserve System.

Moreover, Chart 3 suggests that subprime delinquency rates may stabilize soon. Bank default forecasts can be a useful indicator for future delinquencies. For example, when subprime default forecasts (dashed purple line) fell sharply in 2020, delinquencies (solid purple line) followed suit, albeit at a lag of approximately 12 to 18 months. Given that subprime default forecasts plateaued in early 2023, the trend suggests that subprime delinquency rates could stabilize in the coming quarters as well.

On balance, consumer credit markets show limited evidence of mounting stress, even among subprime borrowers. Although subprime delinquencies have increased, rollover behavior and bank forecasts for these borrowers do not indicate a major deterioration in credit quality. Moreover, the recent easing in monetary policy may limit further deterioration in this market._

Endnotes

-

1

Loan-level data on default forecasts are drawn from the Federal Reserve’s FR Y-14M report. These data are collected monthly from bank holding companies with consolidated assets of $100 billion or more as part of the stress-testing program.

-

2

Delinquent loans are “past due” on payments but not yet considered a loss (or charge-off). A default forecast measures the probability of the loan becoming uncollectable, resulting in a loss.

-

3

The Federal Open Market Committee voted to reduce the target range of the federal funds rate by 50 basis points in September 2024 and a further 25 basis points in November.

Jordan Pandolfo is an economist at the Federal Reserve Bank of Kansas City. The views expressed are those of the author and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.