The financial fallout from the global pandemic in early March tightened credit conditions at an unprecedented pace. This period of financial stress was characterized by an “illiquidity phase” in which investors fled risky assets for the safety and liquidity of Treasury securities and cash.

Some elements of this financial stress and illiquidity phase can be explained as a classic run on “shadow banks”—financial institutions that are not part of the regulated banking system but that, like banks, hold long-term assets funded with short-term debt (Noeth and Sengupta 2011). All banks are vulnerable to runs: no bank can repay all its depositors without liquidating some or all of its long-term assets prematurely (Diamond and Dybvig 1983). However, regulated banks have access to safeguards against runs that shadow banks do not. Specifically, banks have access to deposit insurance through the Federal Deposit Insurance Corporation (FDIC) and liquidity support through the Federal Reserve’s discount window in its role as “lender of last resort.”

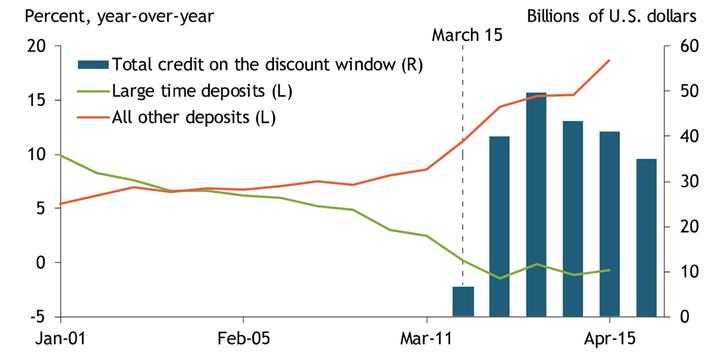

These safeguards against bank runs became increasingly important as credit conditions tightened. Chart 1 shows that for regulated U.S. banks, the effect of financial stress was twofold. First, banks saw a net outflow in large time deposits (green line), a category that includes most uninsured deposits._ Second, banks saw an almost $1 trillion increase in all other deposits (orange line), indicating a flight to the safety of deposit insurance.

Chart 1: Bank Deposit Growth and Discount Window Credit

Source: Board of Governors of the Federal Reserve System (Haver Analytics).

In addition, banks increased their borrowing at the Federal Reserve’s discount window. On March 15, 2020, the Federal Reserve lowered the primary credit rate—the rate at which banks can borrow at the discount window—by 150 basis points to 0.25 percent. The blue bars in Chart 1 show that discount window credit increased substantially shortly thereafter. Overall, Chart 1 suggests that both deposit insurance and the liquidity backstop of the discount window helped safeguard regulated banks against a run on their deposits.

In contrast, most shadow banks have neither insurance for their creditors nor access to a central bank liquidity backstop, making them more vulnerable to runs._ To illustrate this vulnerability, we first explore the effects on one type of shadow bank: prime money market funds (MMF)._

Prime MMFs, which have over $1 trillion in assets, are marketed to retail and institutional investors seeking to purchase a pool of short-term (corporate) securities that generally provide higher returns than interest-bearing bank accounts. These funds are considered shadow banks because even though they invest in short-term assets, they offer redemptions on demand.

Runs on prime MMFs are not a new phenomenon. In 2008, the Reserve Primary Fund, which had a small exposure to Lehman Brothers, experienced a run that reduced its assets by $23 billion and set off a panic of redemptions across all other MMFs (Alnahedh and Bhagat 2017). After the crisis, the U.S. Securities and Exchange Commission (SEC) instituted money market reforms that included floating net-asset values, liquidity fees, and gated redemptions on prime MMFs in an attempt to mitigate these run incentives.

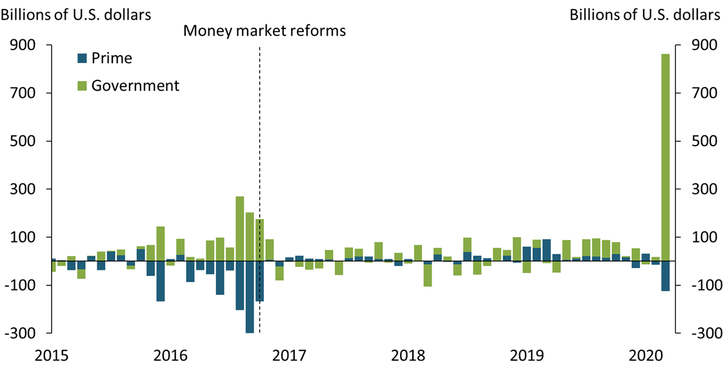

However, even with these changes in place, prime funds were unable to stem the outflows into less risky government funds during the recent period of financial stress. Chart 2 shows the effects of both the 2016 money market reforms and the 2020 stress period in terms of monthly flows between prime funds (blue bars) and government funds (green bars). In the year before the new SEC rules went into effect (dashed vertical line), risk-averse investors moved roughly $1 trillion from prime funds into government funds.

The long lag between the adoption (July 23, 2014) and implementation (October 14, 2016) of the new rules provided both investors and the prime funds sufficient time to adjust to redemptions. In contrast, in March 2020 investors moved over $100 billion from prime funds into government funds (far-right green and blue bars in Chart 2). This time, the flow was unanticipated, abrupt, and disruptive, constituting a run on prime MMFs and a sudden flight to safety._

Chart 2: Money Market Funds (Monthly Flows)

Sources: SEC, Office of Financial Research, and authors’ calculations.

Prime MMFs provide some critical short-term funding for large corporations and banks, and the run on prime MMFs disrupted the funding markets for both commercial paper and bank certificates of deposit. The Federal Reserve intervened quickly to address concerns on both sides of the balance sheet of prime money market funds. On March 17, the Federal Reserve revived its crisis-era Commercial Paper Funding Facility and relieved the strains on this market. The very next day, the Federal Reserve also revived its Money Market Liquidity Facility to provide funding support for prime money funds. These facilities eased strains in funding markets reducing commercial paper spreads and redemptions on prime funds.

Financial stress also generated runs on other shadow banks such as mortgage real estate investment trusts (mREITs), which invest in mortgage-backed securities (MBS). To simplify, we focus on mREITs that predominantly hold agency MBS—securities with minimal credit risk. These mREITs fund their holdings of agency MBS by issuing publicly traded equity and then leveraging the equity position using short-term repo funding (that is, secured borrowing by pledging agency MBS as collateral). This short-term funding of longer-term agency MBS assets makes mREITs shadow banks.

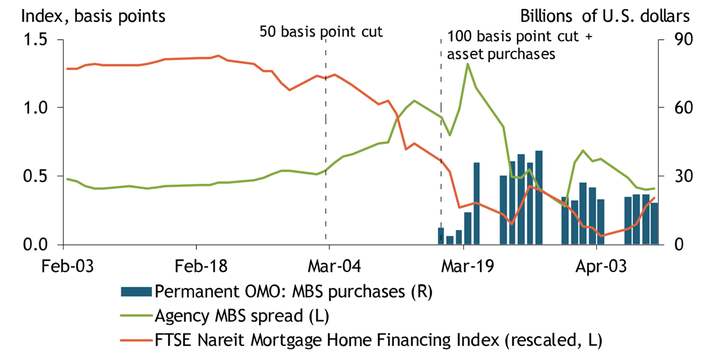

Around mid-March, mREITs faced a shadow bank run in the form of margin calls, in which lending banks refused to roll over credit unless mREITs posted more collateral (agency MBS) for the same loan amount (Gorton and Metrick 2012). Chart 3 shows a decline in mREIT stock prices, as measured by the FTSE Nareit Mortgage Home Financing Index (orange line), around the same time. It is unclear what led dealer banks to issue margin calls (Armstrong 2020)._ The margin calls may have been triggered by a general deterioration in market liquidity, akin to a self-fulfilling bank run.

Regardless of the trigger, margin calls forced mREITs to sell assets and reduce leverage to make up for the funding shortfall. The forced deleveraging by mREITs created a downward spiral as mREIT sales reduced the price of the assets held on their balance sheet—namely, agency MBS—leading to even more asset sales (Shleifer and Vishny 2011). The selling pressure stressed dealer balance sheets and drove up spreads on agency MBS as measured by the Bloomberg Barclays Agency Fixed-Rate MBS Average Option-Adjusted Spread (green line).

Chart 3: Mortgage REITs, Agency MBS Spreads, and Open Market Operations (OMOs)

Sources: Bloomberg, Federal Reserve Bank of New York (Haver Analytics), and authors’ calculations.

As with prime MMFs, the Federal Reserve intervened quickly to reduce volatility in the market for agency MBS. On March 15, the Federal Reserve resumed permanent open market purchases of agency MBS, as shown by the blue bars in Chart 3. As the Federal Reserve Bank of New York’s Trading Desk expanded its operations to accommodate mREIT fire sales, selling pressures on agency MBS eased and agency MBS spreads declined._ Anecdotally, industry analysts estimate that forced deleveraging has reduced nearly one-quarter of mREIT holdings (Zuckerman and Eisen 2020).

Although the Federal Reserve’s actions appear to have mitigated runs on shadow banks associated with the global coronavirus pandemic, recent financial stress has revealed structural weaknesses in U.S. credit markets. Backstops such as the Federal Reserve’s discount window can help banks weather liquidity shocks, but the discount window is only available to depository institutions in generally sound financial condition._ Without access to a designated liquidity backstop from a regulated bank or the Federal Reserve, shadow banks will remain vulnerable to runs in times of financial crisis.

Endnotes

-

1

The category “large time deposits” in H.8 data from the Board of Governors includes deposits in excess of $100,000. However, only those deposits in excess of $250,000 are not insured by the FDIC. Meanwhile, the category “other deposits” includes most insured deposits.

-

2

The terms “shadow banks” and “nonbanks” and are often used interchangeably, but not all nonbanks can be characterized as shadow banks. For example, nonbanks such as insurance companies and pension funds are typically not considered shadow banks because their funding does not predominantly rely on short-term debt. Although insolvencies hit all nonbanks, we focus on shadow banks because their maturity transformation makes them vulnerable to disruptive runs.

-

3

Money market funds are mutual funds regulated by the Securities and Exchange Commission (SEC) that invest in fixed-income assets of short maturity and high credit quality. Depending on the focus of the fund, they may include short-term debt securities issued by the U.S. government, corporations, or local government and municipalities. Broadly speaking, all money market fund types are shadow banks.

-

4

At the height of the recent stress period, some of the largest banks that manage prime funds had to provide liquidity injections to stem the outflows. These liquidity injections were intended to prevent the weekly liquid assets of the funds from falling below 30 percent of their total assets and triggering gated redemptions and liquidity fees that reduce the funds’ attractiveness to potential investors.

-

5

Anecdotal evidence suggests that margin calls may have been prompted by hedging losses as the Federal Reserve cut rates. Mortgage REITs that hold agency MBS face minimal credit risk but are exposed to interest rate risk on their short-term funding. Often, mREITs will hedge interest rate risk on their short-term repo funding using interest rate swaps that are predicated on gradual rate cuts by the Federal Reserve. When the Federal Reserve cut rates abruptly, first by 50 basis points on March 3 and then to zero on March 15, mREITs incurred large losses on their swap hedging positions.

-

6

The Desk adjusted to short settlements to ensure a quick supply of liquidity to mREITs. As the Desk’s statements on March 19–20 note, additional “purchases are intended to address highly unusual disruptions in the market for agency MBS associated with the coronavirus outbreak” (Federal Reserve Bank of New York).

-

7

For details on the eligibility of the discount window, see Federal Reserve (2020).

References

Alnahedh, Saad, and Sanjai Bhagat. 2017. “External LinkShadow Banking Concerns: The Case of Money Market Funds.” University of Colorado Boulder, working paper, March.

Armstrong, Robert. 2020. “External LinkMortgage Investment Funds Become ‘Epicentre’ of Crisis.” Financial Times, March 24.

Diamond, Douglas W., and Philip H. Dybvig. 1983. “External LinkBank Runs, Deposit Insurance, and Liquidity.” Journal of Political Economy, vol. 91, no. 3, pp. 401–419.

Federal Reserve. 2020. "External LinkThe Discount Window: Eligibility to Borrow."

Federal Reserve Bank of New York. 2020. “External LinkStatement Regarding Agency MBS Purchase Operations.” March 19.

Gorton, Gary, and Andrew Metrick. 2012. “External LinkSecuritized Banking and the Run on Repo.” Journal of Financial Economics, vol. 104, no. 3, pp. 425–451.

Noeth, Bryan J., and Rajdeep Sengupta. 2011. “External LinkIs Shadow Banking Really Banking?” Federal Reserve Bank of St. Louis, Regional Economist, October 1.

Shleifer, Andrei, and Robert Vishny. 2011. “External LinkFire Sales in Finance and Macroeconomics.” Journal of Economic Perspectives, vol. 25, no. 1, pp. 29–48.

Zuckerman, Gregory, and Ben Eisen. 2020. “External LinkMortgage Firm Struggles to Meet Margin Calls as Market Turmoil Continues.” Wall Street Journal, March 23.

Rajdeep Sengupta is an economist at the Federal Reserve Bank of Kansas City. Fei Xue is a research associate at the bank. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.