The commercial real estate (CRE) sector shifted significantly after the COVID-19 pandemic, as more remote work led to increased office vacancies. If higher office vacancy rates persist, losses could accrue not only to owners of those properties, but also to the banks and other financial intermediaries that finance them. Similarly, the late 1980s also saw broad structural changes and regional downturns weigh on property prices, especially in the office subsector. Many small banks faced losses and eventually failed, weakening economic activity in their regions.

To assess how an exacerbation of current distress in the CRE market might affect banks, Padma Sharma and Brendan Laliberte measure the effects of CRE-related distress during the crises in the 1980s and 1990s and use a stress-testing approach to apply those losses to present-day bank balance sheets. They show that banks in the 1980s and 1990s that were exposed to regional distresses, or that grew their CRE portfolios rapidly, had elevated levels of non-performing loans, leading to losses that persisted on their balance sheets for several years. However, banks today may be better able to weather these losses. Overall, the current distress in CRE is unlikely to reach the peaks of the 1980s and 1990s, though the recovery from ongoing CRE strains is fraught with uncertainty.

Introduction

The COVID-19 pandemic upended a decade-long streak of sustained growth and price rises in the commercial real estate (CRE) sector by changing how individuals live and work. The shift to remote and hybrid work, for example, has led to increased office vacancies as individuals increasingly work from home. If office vacancy rates in major metropolitan areas remain elevated, losses are likely to accrue not only to owners of those properties, but also to the banks and other financial intermediaries that finance them. Indeed, banks are already reporting higher levels of nonpayment on CRE loans and expect to see higher default rates on office properties in the near future (FDIC 2024; Marsh and Pandolfo 2024).

Historical experience may provide some insight into how distress in the CRE sector could evolve. In the late 1980s, for example, broad structural changes, such as the removal of tax incentives for income from CRE, weighed on property prices nationally, while regional downturns in the Southwest and Northeast amplified price declines in these areas. Notably, in a parallel to current developments, the office subsector faced more dire prospects relative to other categories of CRE properties. Many small banks with elevated exposures to distressed classes of CRE loans faced losses and eventually failed. These losses eroded banks’ ability to provide loans and provoked a credit crunch in the Northeast, which weakened economic activity in the region (Bernanke, Lown, and Friedman 1991; Peek and Rosengren 1995). It took until the mid-1990s for property prices to start rising again and for banks’ nonperforming loans to stabilize.

To assess how an exacerbation of current distress in the CRE market might affect banks, we measure the effects of CRE-related distress during the crises in the 1980s and 1990s and use a stress-testing approach to apply those losses to present-day bank balance sheets. We show that banks in the 1980s and 1990s that were exposed to regional distresses, or that grew their CRE portfolios rapidly, had elevated levels of non-performing loans, leading to losses that persisted on their balance sheets for several years. However, we also find that banks today may be able to better weather these losses: even if current losses escalate to the levels seen in the 1980s–90s, capital levels would remain above regulatory thresholds at most institutions. The institutions with the greatest risk of falling short of capital benchmarks are those with high exposures to office properties in regions with elevated vacancy rates. Overall, our results suggest that the current distress in CRE is unlikely to reach the peaks of the 1980s and 1990s, though the recovery from ongoing CRE strains is fraught with uncertainty.

Section I compares the sources of current distress in CRE with those in the 1980s and 1990s. Section II describes the effects of different drivers of distress in CRE in the 1980s and 1990s on bank loan performance. Section III applies the loss estimates from the crises of the 1980s and 1990s on present-day bank balance sheets and assesses their effects on bank capital. Section IV discusses the results in the context of institutional and regulatory changes that have taken place since the 1980s and presents an outlook for CRE risks in the banking industry.

I. Sources of Distress in CRE, Then and Now

The CRE sector is susceptible to boom and bust cycles characterized by a period of overbuilding amid rising property prices followed by elevated vacancy rates and price declines. The United States has undergone several cycles of varying amplitude over the last century, each marked by disparate sources of price growth and decline (Kaiser 1997). These sources may include developments specific to the CRE sector or broader economic conditions such as growth and inflation (as well as the monetary policy responses to those conditions).

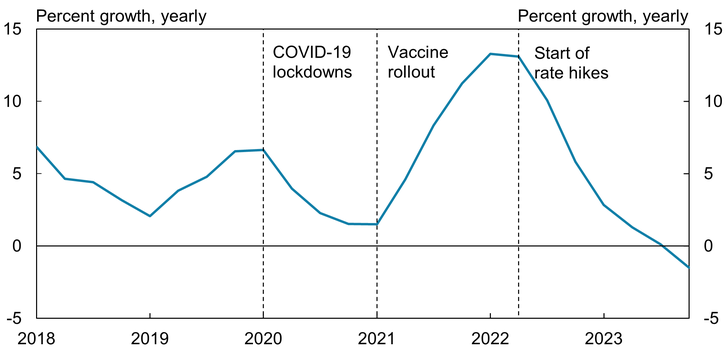

The current period of elevated vacancy rates and price declines was induced by the pandemic and later amplified by higher interest rates. Chart 1 depicts yearly growth in CRE prices since 2018. When the COVID-19 pandemic erupted in 2020, growth in commercial property prices slowed as social distancing measures curtailed the use of malls, hotels, and offices. However, this slowdown was likely mitigated by policy interventions, as the Federal Reserve quickly reduced interest rates to zero in March 2020._ As vaccines began to roll out in early 2021, property prices began to rise rapidly alongside expectations that individuals and firms would resume their pre-pandemic use of spaces such as shopping centers and offices. Interest rates remained zero at this time, further boosting property prices. However, this support did not last. When the Federal Reserve began to raise interest rates in 2022, CRE property prices decelerated and eventually began to decline in late 2023.

Chart 1: Yearly Growth in Commercial Real Estate Price Index (2018–23)

Sources: Board of Governors of the Federal Reserve System and authors’ calculations.

Although rising interest rates weigh on prices for all properties, a subcategory of commercial properties—offices, especially those in central business districts—faced additional valuation declines from enduring shifts to remote work in the wake of the COVID-19 pandemic. Companies have increasingly adopted permanent hybrid or remote work policies, thus reducing the demand for office space and exacerbating high vacancy rates (Gupta, Mittal, and Van Nieuwerburgh 2022). As a result, the price of office space has fallen more than the prices of other commercial properties._ Indeed, the potential obsolescence of office properties represents the dominant risk in the CRE sector at present.

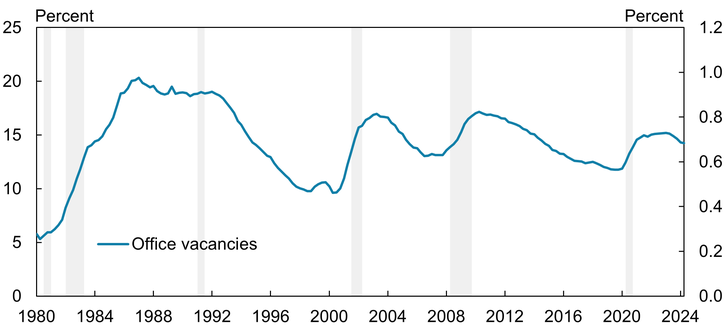

Remarkably, offices were also the property type most impaired by escalating vacancies and valuation declines during the CRE crises of the 1980s and 1990s._ Chart 2 shows that vacancy rates rose over the 1980s to reach 20 percent in late 1986 and remained elevated through late 1992. More recently, office vacancy rates have risen gradually from 12 percent in 2019 to a peak of 15 percent in 2023; they have since remained elevated._ Although vacancy rates also spiked during the dot-com bubble of the early 2000s and the global financial crisis, they remained at their peak for only two quarters.

Chart 2: Office Vacancy Rates (1980–2024)

Note: Gray bars denote National Bureau of Economic Research (NBER)-defined recessions.

Sources: CBRE and NBER.

The CRE crises in the 1980s and 1990s emanated from shocks to the real estate sector in certain regions such as the Southwest (in particular, Texas) and the Northeast, as well as from reversals of national legislation that had previously incentivized construction of and investment in commercial property.

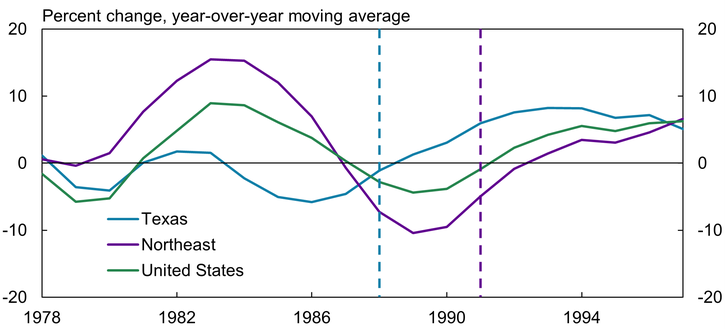

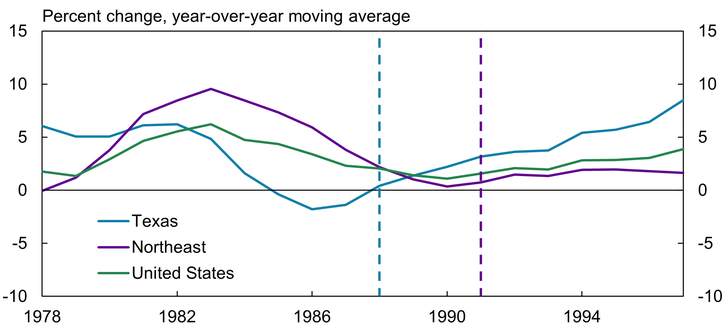

Chart 3 depicts the yearly change in GDP from the construction and real estate sectors in Texas, the Northeast, and the United States._ The blue solid line in Panels A and B shows that construction and real estate activity in Texas weakened starting in 1983, when oil prices began to slowly decline, and reached a trough in 1986, corresponding to a sharp decline in oil prices from $30 a barrel in January to $10 a barrel in August 1986. The purple line in both panels shows that real estate activity began to slow and construction activity began to contract in the Northeast in the late 1980s, corresponding to contractions in defense spending as well as in the finance and technology industries. These sectors had previously supported growth in the region’s employment and income, thereby boosting growth in real estate and construction activity._ This weakening in real estate activity resulted in blocks of vacant offices in major cities in the Northeast and Texas, steep declines in property prices, and losses to owners who became unable to service loans against those properties.

Chart 3: Industry-Specific GDP by Region

Panel A: Construction

Panel B: Real Estate

Notes: Vertical lines denote peak of bank failures in each group. Northeastern states in our analysis consist of New York, Connecticut, Massachusetts, Rhode Island, and New Hampshire.

Sources: U.S. Bureau of Economic Analysis and FDIC.

In addition to these more intense, region-specific declines, CRE activity also declined at the national level in the late 1980s—marking the end of a period of tax incentives and lax regulation that had induced rapid CRE loan growth. The green line in Panels A and B of Chart 3 shows that after rising steadily from the early to mid-1980s, construction activity declined and real estate activity slowed notably in 1986, a year in which policymakers reversed legislation that had offered tax incentives for CRE investments._ Later in the decade, policymakers also increased regulation on financial intermediaries, as many depository institutions had failed from losses on loans to speculative CRE investors._ The sector contracted further: property prices collapsed 20 percent between 1989 and 1994, the largest such decline since the post-war period began. Taken together, excess supply of commercial properties from overbuilding in the early 1980s intersected with weakened demand from reversals of legislative incentives to produce a significant downturn in the CRE sector in the late 1980s and early 1990s.

II. How Did Regional Shocks and Portfolio Decisions Affect Bank Loan Performance in the 1980s and 1990s?

The 1980s and early 1990s were not only marked by distress in CRE, but also by a crisis in the banking and savings and loans industries that saw the failure of over 1,600 banks. Indeed, studies have identified exposure to CRE loans as an important driver of both bank losses and bank failure (Cole and Gunther 1995; Balla and others 2019). Accordingly, this episode provides an important reference point for a CRE crisis that had consequential spillover effects to the banking sector.

We consider two key drivers of the CRE crises during the 1980s and 1990s—regional downturns and rapid CRE loan growth during a period of legislative incentives and deregulation—and evaluate differences in loan performance across banks with different levels of exposure to each driver. Broadly, the distress in CRE during the 1980s and 1990s consisted of notable downturns in Texas and the Northeast and broader distress in the sector from reversal of legislative incentives at the national level; banks headquartered in Texas or the Northeast were more likely to experience stress in their CRE loans relative to banks headquartered in other regions. In addition, banks that ramped up their CRE portfolios rapidly during the early 1980s were likely exposed to higher levels of credit risk than those that grew their portfolios more deliberately. Because of the deregulatory policies and tax incentives in play at the time, banks that quickly expanded their CRE portfolios were more likely to have followed lax underwriting standards and lent to speculative investors.

To evaluate the effects of regional shocks and banks’ portfolio decisions on loan performance, we segment all U.S. banks based on the state in which they are headquartered as well as by the speed with which they grew their CRE portfolios from 1980 to 1985. We then examine differences in loss rates for banks exposed to each driver relative to a benchmark group of banks with less or no exposure to these drivers. Specifically, we examine differences in banks’ real estate net charge-off rates—the share of real estate loans taken off the loan books after borrowers stop making payments on them for a considerable period—net of any amount subsequently recovered from borrowers. From the banks’ perspective, this ratio represents the part of their loans that they consider to be unrecoverable.

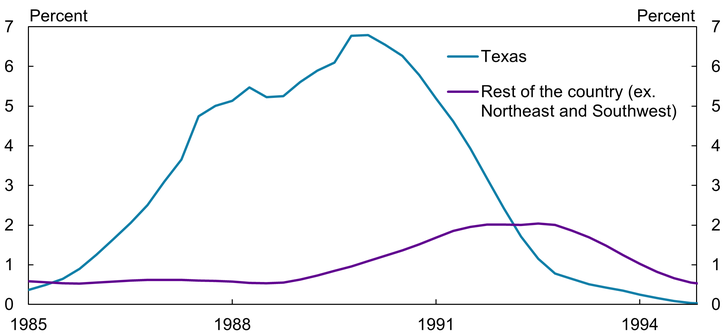

Chart 4 represents the real estate net charge-off rate for banks across segments based on differential exposure to each of the drivers of the crises from the 1980s and 1990s. Panel A illustrates charge-off rates for banks headquartered in Texas (in blue) and the rest of the country (in purple), excluding those headquartered in Northeastern and other Southwestern states._ Charge-off rates at Texas banks rose steeply relative to the rest of the country. By the end of 1989, charge-off rates were nearly 7 percent for Texas banks but only 1.5 percent for the rest of the country. Despite this steep rise, charge-off rates among Texas banks began to return to levels consistent with the rest of the country by 1992, and soon fell below charge-off rates in the rest of the country.

Chart 4: Net Charge-Off Rate by Bank Segments

Panel A: Texas

Panel B: Northeast

Panel C: Rate of CRE Growth

Sources: FFIEC and authors’ calculations.

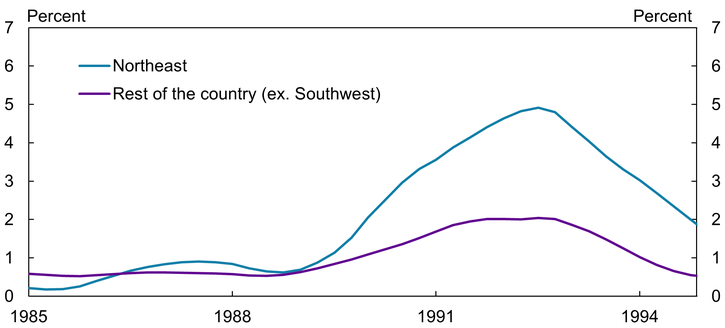

Charge-off rates among banks in the Northeast were lower than those of Texas banks but persisted at relatively elevated levels for a longer period. Panel B of Chart 4 shows that real estate net charge-off rates for banks headquartered in any of the Northeastern states (blue line) peaked at close to 5 percent at the end of 1992, while equivalent rates for the rest of the country excluding the Southwest (purple line) were around 2 percent. However, by the end of 1994, Northeastern banks continued to experience net charge-off rates that were 1.5 percentage points higher than those in the rest of the country.

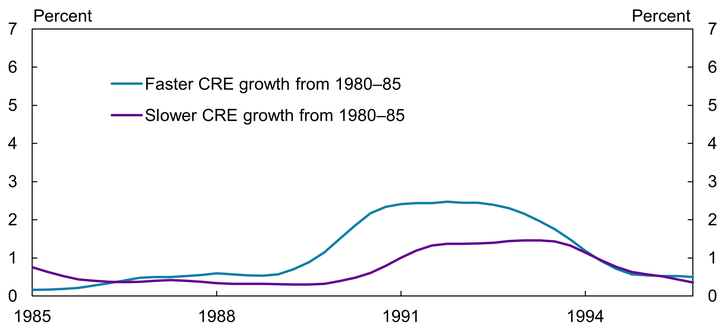

Finally, charge-off rates were higher for banks with more rapid CRE loan growth from 1980 to 1985 than for banks that grew their CRE portfolios more slowly. Panel C of Chart 4 shows that charge-off rates reached 2.5 percent in 1991 for banks with faster CRE loan growth (blue line), compared with only 1.4 percent for banks with slower CRE loan growth (purple line). This difference tapered out by 1993, and charge-off rates for both groups subsequently fell below 1 percent. Because net charge-off rates were notably lower for banks with faster CRE loan growth than for banks located in Texas and the Northeast, exposure to adverse economic shocks likely had more deleterious effects than weaknesses in banks’ portfolio decisions.

Overall, Chart 4 shows that CRE-distressed banks in the 1980s and 1990s had three different trajectories depending on their source of stress. Texas banks saw a notably steep rise in their real estate net charge-off rates, Northeastern banks saw a more gradual and persistent rise, and banks that expanded their CRE loans more rapidly saw relatively smaller and less persistent increases.

III. Projected Scenarios for the Current Distress in CRE

The distinct experiences of different bank segments during the CRE crises in the 1980s–90s may help shed light on the potential effects of CRE-related stress today. One salient risk in the CRE sector today is the shift to remote work and potential obsolescence of some offices in the central business districts of large cities (Glancy and others 2023; Gupta, Mittal, and Van Nieuwerburgh 2022; Monte, Porcher, and Rossi-Hansberg 2023; Metcalfe, Spinelli, and LaSalvia 2024; Boyle 2024). If persistent office vacancies continue and impede building owners from repaying their loans, then banks with elevated exposures to these types of loans may experience losses.

To evaluate potential outcomes for banks that are more likely to have financed offices in the central business districts of large cities, we apply the loss experiences of distressed bank segments from the 1980s and 1990s on this subgroup and project their performance under alternative scenarios of escalating distress. Subsequently, we assess whether the banking system has the capacity to absorb these losses by evaluating their effect on current bank capital positions.

One challenge in identifying banks that are more likely to have financed offices in large cities is a lack of granular data on the location and type of banks’ borrowers. Accordingly, we examine the geographic footprint of banks’ branch networks and assume that banks that obtain most of their deposits from branches in large cities are more likely to lend to borrowers in those areas. In particular, we use Summary of Deposits data from the FDIC to locate institutions that obtain a majority of their deposits from branches in large counties (where we define large counties as those with a population in excess of 500,000)._ The remaining banks—those that obtain less than half of their deposits from branches in large counties—form our benchmark group.

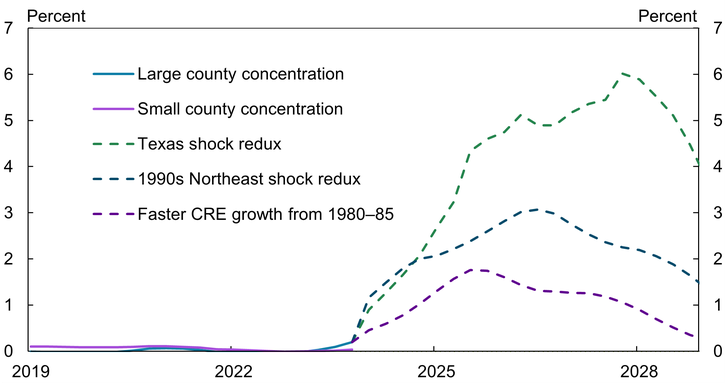

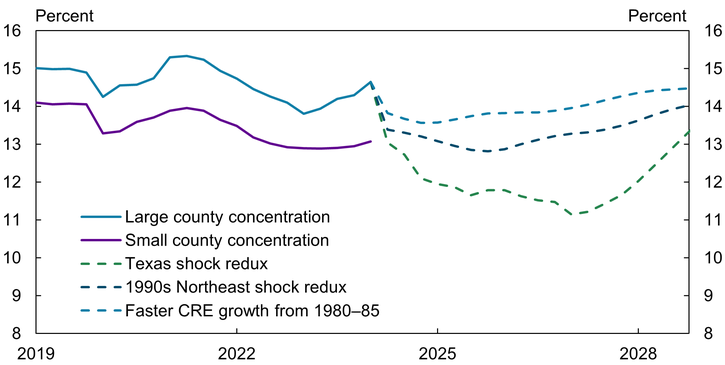

Chart 5 depicts the real estate net charge-off rates of banks with deposit concentrations in large counties (blue line) and banks in our benchmark group (purple line) until December 2023 alongside projections for these rates based on stress scenarios through 2028. Although both lines are near zero, banks with deposit concentrations in large counties had slightly lower real estate net charge-off rates than those with concentrations in small counties until the end of 2022. In early 2023, however, banks with concentrations in large counties began to face higher net charge-off rates than the benchmark group, consistent with our hypothesis that these banks are more exposed to recent CRE-related stresses.

Chart 5: Real Estate Net Charge-Off Rates for Banks in Large Counties and Their Projections under Adverse Scenarios

Sources: FFIEC and authors’ calculations.

The dashed lines depict how net charge-off rates might evolve under three potential crisis scenarios._ The green dashed line depicts projections based on the most extreme risk scenario, in which net charge-off rates are based on the experience of Texas banks in the 1980s crisis. Under this scenario, charge-off rates peak at 6 percent by the end of 2027 and decline to 4 percent by the end of 2028. The blue dashed line represents a more moderate risk scenario, in which net charge-off rates are based on the CRE crisis in the Northeast. Under this scenario, net charge-off rates rise more gradually and peak at 3 percent at the end of 2026 before declining to 1.3 percent at the end of 2028. Finally, the purple dashed line represents the least adverse scenario, in which the path for net charge-off rates is based on the losses experienced by banks that grew their CRE portfolios aggressively in the 1980s. Under this scenario, net charge-off rates rise to 1.8 percent toward the end of 2025 and decline steadily to 0.2 percent by the end of 2028. Because banks with concentrations in small counties are our benchmark, we do not evaluate the scenarios for this group.

To assess whether banks are prepared to withstand the type of stress represented by these three historical scenarios, we next quantify the effect of the projected real estate net charge-off rates on banks’ capital ratios. Loans that are charged off on banks’ books only affect capital through a series of intermediate accounting entities, the most salient being the Allowance for Loan and Lease Losses (ALLL) and net income. The ALLL represents funds that banks set aside to meet future loan losses and are thereby based on banks’ projected charge-off rates. When banks increase ALLL in expectation of rising charge-offs, they designate an expense category called “provisions” to meet this increase, which lowers their net income. Net income is added to bank capital each quarter; when additions to ALLL or provisions are large enough, net income turns negative and erodes capital.

In connecting real estate charge-offs and capital ratios, we make a few assumptions. First, we assume charge-off rates on all loan categories except for real estate remain fixed at their 2023 levels. Any incremental changes in charge-offs arise mainly from real estate loans. Second, we assume capital levels remain fixed at 2023 levels and that all subsequent changes arise from the increases in charge-offs that then affect net income. Third, we assume banks set aside loss allowances according to the “tunnel” provision framework of Hirtle and others (2016). This assumption is required because allowances are not determined by a mechanical rule, but instead based on accounting guidelines and managerial discretion. This approach to setting aside provisions entails comparing current levels of allowances with different multiples of projected net charge-offs to determine whether to build up allowances or to “release” them if allowances are determined to be higher than required. Further details about tunnel provisions and our method for projecting capital are provided in Appendix A.

Chart 6 illustrates the effects of the projected distress on banks’ Tier 1 capital ratios. Although capital ratios remain above the regulatory threshold of 8 percent across all scenarios, they fall below current levels, undermining existing buffers. Over the 2019–23 period, the capital ratio for banks concentrated in large counties (solid blue line) has remained consistently above the ratio for banks with concentrations in small counties (solid purple line). In the forecast horizon starting in 2024, the dashed lines reflect the extent to which charge-offs in each scenario undermine bank capital. Not surprisingly, capital ratios are impaired most under the scenario based on Texas banks in the 1980s (dashed green line), falling from levels close to 15 percent at the end of 2023 to reach lows of around 11 percent by early 2027. Capital ratios are less impaired under scenarios based on Northeastern banks and banks with aggressive CRE growth in the 1980s, declining to troughs of 13 percent at the end of 2025 and 14 percent at the end of 2024, respectively.

Chart 6: Observed and Projected Capital Ratios for Banks in Large Counties

Sources: FFIEC and authors’ calculations.

We caveat our projections by noting that a high concentration of deposits from large counties is unlikely in and of itself to be a source of stress for banks. We use the concentration of bank deposits by county size to proxy for banks’ exposure to loans financing offices in large cities because data on the location or type of bank borrowers are not available for all banks._ Moreover, the use of office space varies substantially across large metropolitan areas: rented office space has declined in cities such as San Francisco and Seattle but increased in Tucson and Nashville (Rappaport 2024). Accordingly, banks’ outcomes will be determined by the prospects for offices in the specific geographic areas in which their loans are concentrated.

Overall, our estimates suggest that if rising office vacancies stress banks’ CRE loans to produce the level of losses from the 1980s and 1990s, the capital ratio for the banking system in the aggregate will fall but remain above regulatory thresholds. However, individual institutions with excessive exposure to loans in areas with acute office vacancies may fall short of regulatory benchmarks.

IV: Outlook and Implications for U.S. Banks

The experience of the 1980s and 1990s provides insights into the likely path and persistence of a CRE crisis on banks’ balance sheets._ However, the specific contours of the contemporary distress are unlikely to unfold in the same manner, since the banking industry and regulatory environment have changed substantially since the 1980s. Moreover, the COVID-19 shock that gave rise to the recent stresses is unprecedented.

The three historical scenarios that we evaluate reflect varying levels of severity of a potential crisis. The scenario based on rapid growth in CRE portfolios provides a meaningful benchmark for the trajectory of likely losses to banks in the absence of additional economic shocks. The other two scenarios, derived from the real estate crises in Texas and the Northeast, illustrate the potential for more adverse outcomes—for example, if a large sectoral or macroeconomic shock were to interact with the ongoing distress in CRE. Such shocks would weaken fundamentals underlying the CRE sector, such as vacancy rates, property valuations, and borrowers’ ability to service their debt, thereby intensifying bank losses.

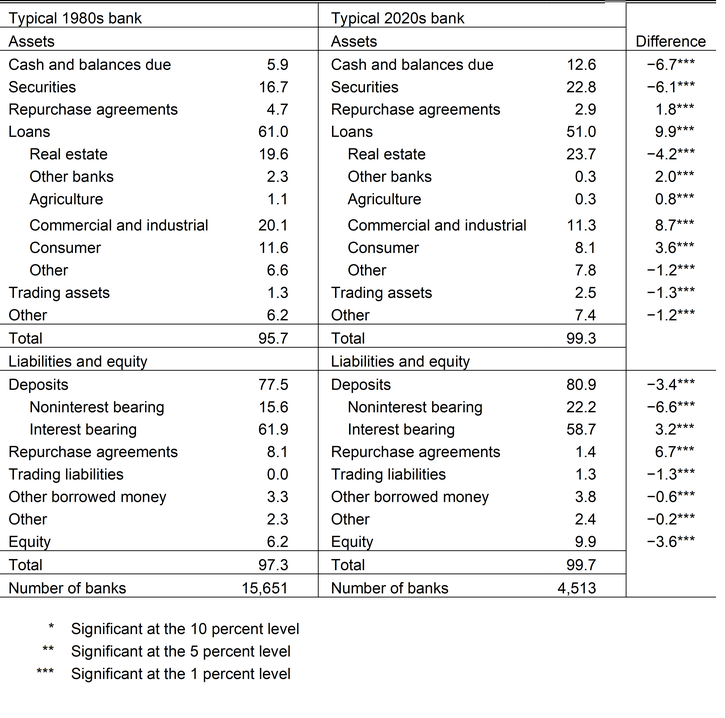

A host of banking reforms and institutional shifts in CRE lending since the 1980s and 1990s will likely prevent current strains from deteriorating to the peaks of the previous crisis even in the face of an economic shock. First, banks are more diversified across regions today than they were in the 1980s and 1990s, when they were limited by interstate banking and branching restrictions. These restrictions were gradually relaxed over the 1980s and fully removed following the Riegle-Neal Interstate Banking and Branching Efficiency Act (Kroszner and Strahan 1999). Moreover, the current distress is mainly restricted to office properties in central business districts, especially in large cities. Although office valuations also weakened in the 1980s and 1990s, prices of other commercial properties, such as industrial and retail buildings, declined in that period as well (FDIC 1997). Given banks’ more diversified portfolios and the relatively contained nature of the ongoing distress, banks may experience losses on loans collateralized by offices in markets with high vacancy rates but face little or no deterioration on loans in other geographies or CRE segments._ Finally, other types of CRE lenders, such as Real Estate Investment Trusts (REITs) and Commercial Mortgage-Backed Securities (CMBS) have expanded their asset base since the 1990s (Garner 2008). CMBS issuers in particular hold the largest CRE loans, which likely face more adverse prospects than smaller loans, as ongoing shifts have particularly weighed on the largest office buildings (Glancy and Wang 2022; Marsh and Pandolfo 2024). Accordingly, CRE risks are less concentrated in bank balance sheets today than during the crisis of the 1980s and 1990s and are shared across other categories of lenders.

Furthermore, bank balance sheets are stronger today relative to the 1980s and 1990s and better prepared to withstand a period of elevated losses. Banks currently hold higher levels of capital and are subject to increased capital regulation relative to the prior crisis period. Banks during that time were not yet subject to risk-based capital requirements, which only began to be implemented in 1990 (see Appendix B, Table B-1 for differences in banks’ capital position across the two periods). Importantly, capital buffers alleviate the possibility of a real estate crisis devolving into a credit crunch such as the one that occurred in New England in the 1990s, when banks reeling from CRE losses withheld lending and thereby stymied economic activity (Peek and Rosengren 1995).

Another distinguishing factor of the ongoing turmoil in the CRE sector is that it is not the result of deliberate risk-taking by banks or other financial institutions. Contemporary distress in CRE, particularly in offices, was not preceded by a building boom like the crises in Texas and the Northeast. In the 1980s and 1990s, banks were competing among themselves and with savings and loans institutions to draw CRE borrowers, some of whom engaged in construction projects only to take advantage of tax incentives rather than to fill a genuine economic need. The interaction of the building boom, speculative activity, and economic shocks together contributed to the severity of the previous crisis. The current turmoil in the office CRE sector originated from a health crisis rather than a construction boom, indicating that the quality of loans on bank books are likely of better quality than those made by rapidly expanding banks during the real estate booms in Texas and the Northeast.

Although several institutional features and economic factors will likely prevent the ongoing distress from reaching the severity of the 1980s and 1990s, the recovery out of this distress is subject to greater uncertainty. The recovery from the previous CRE crisis was driven by economic growth: vacancies in offices gradually declined as economic growth led to an increase in office employment. In the current scenario, however, economic growth and increases in employment will not necessarily alleviate high vacancy rates in office properties if companies continue to occupy smaller footprints, and property prices and bank balance sheets may take longer to recover. Bank losses may thereby build up owing to the duration rather than the severity of ongoing distress in the CRE sector.

Conclusion

The CRE crises of the 1980s and 1990s may shed light on how current turmoil in the office CRE sector could weigh on bank balance sheets. We project the incremental losses faced by distressed banks during the crises of 1980s and 1990s onto present-day banks vulnerable to losses from the shift to remote work. Specifically, we project losses under three likely trajectories for a potential CRE crisis: a sharp and substantial increase in real estate charge-off rates (based on the CRE crisis in Texas), a more gradual and persistent increase in charge-off rates (based on the shock in the Northeast), and an even more moderate and gradual increase in charge-off rates (based on the experience of banks that grew their CRE portfolios aggressively in the early 1980s). These projections can help shed light on how bank capital could evolve if bank losses rise to levels seen in the 1980s and 1990s—either due to continued deterioration in the CRE sector or the interaction between current strains and a macroeconomic shock.

Our projections suggest that while current capital ratios would decline under all scenarios, they would remain above the regulatory threshold of 8 percent. However, individual institutions with particularly elevated levels of office CRE loans in areas with high vacancy rates might struggle with capital adequacy. Moreover, although losses in the current period of stress are unlikely to swell to levels seen in the previous crisis, the current decline in office vacancies is structural, rather than cyclical. An economic upturn, such as the upturn that brought the CRE sector out of the previous crisis, may not foster a recovery in the sector today. As a result, both investors and banks may face a prolonged and uncertain path to recovery.

Appendix A: Projecting Real Estate Net Charge-Off Rates and Capital Ratios

We derive the projected charge-off rates for the period 2024–28 using the following steps:

- We evaluate the difference in charge-off rates between banks exposed to each shock and its corresponding benchmark group for a five-year period since the onset of the crisis in the historical sample. For instance, for the Texas scenario, we consider the difference in charge-off rates between banks headquartered in Texas and those headquartered in other states, excluding the Northeast and other Southwestern states, over the period 1986–90.

- We add this five-year series of incremental charge-off rates on to the observed charge-off rates for banks with concentrations in big counties as of year-end 2023. Thereby, we obtain projections for the period 2024–28. We repeat the exercise for the remaining two stressed historical and benchmark segments.

The projected capital ratios for the period 2024–28 have been derived using the following steps:

- We apply our five-year projections of charge-off rates onto real estate loan balances for banks with concentrations in big counties as of 2023:Q4. This step gives us projected charged-off real estate balances over 2024–28.

- Assuming that total net charge offs (NCO) remain constant at 2023:Q4 levels, we add projected real estate charge-off balances from step 1 to the baseline total NCO in every quarter over the 2024–28 period.

- Starting at period t = 2024:Q1, we compare ALLLt, which is ALLL at period t, to the sum of the projected total NCOs in the following four quarters, represented as NCOt+4 and current quarter net charge-offs NCOt. We then apply the “tunnel” provision rule from Hirtle and others (2016), summarized as follows:

- If NCOt+4 ≤ ALLLt ≤ 2.5 times NCOt+4, then provision expense in quarter t = NCOt.

- If ALLLt < NCOt+4, then provision expense = NCOt+4 - ALLLt.

- If ALLLt > 2 times NCOt+4, then provision expense = NCOt+4 - ALLLt. (ALLL release).

- We subtract provision expense obtained in step 3 from baseline net income to derive projected net income. The baseline net income is its 2023:Q4 value excluding the provision expense from this period and remains constant at this level through the forecast horizon.

- From 2024 through 2028, we add projected net income from the current period to Tier 1 capital from the previous period to obtain current Tier 1 capital. For 2024:Q1, the baseline Tier 1 capital is its 2023:Q4 value excluding the net income from this period. The current Tier 1 capital is divided by the baseline 2023:Q4 risk-weighted asset to yield the Tier 1 capital ratio.

Appendix B: Stylized Balance Sheets of Banks in the 1980s and 2020s

Table B-1 contains stylized balance sheets of banks in the 1980s and the 2020s. We report the share of each asset and liability category as a ratio of total assets or liabilities, respectively, in the two time periods. We also report the results from a statistical test for the difference between the shares of each component between the two time periods and find statistically significant differences across all components (three asterisks in the final column indicate that the null hypothesis was rejected at a 1 percent level of significance).

Table B-1: Stylized Balance Sheets of Banks in the 1980s Compared with the 2020s

Note: Balance sheets are averages across 1985–89 and 2020–23 for the two periods.

Sources: FFIEC and authors’ calculations.

Endnotes

-

1

Property prices move inversely with interest rates. As in the case of other assets, the present discounted value of cash flows from commercial property is high when interest rates are low, and vice versa.

-

2

From 2019 through the first quarter of 2024, prices of offices in central business districts have fallen by around 50 percent, while prices of suburban offices declined by 12 percent. Other property types, such as warehouses and retail spaces, underwent price increases of 46 percent and 15 percent, respectively (data from MSCI RCA and authors’ calculations).

-

3

According to a decomposition of vacancy rates by property type provided in Hendershott and Kane (1992), vacancy rates in the 1980s for offices in downtown and suburban markets peaked at around 16 percent and almost 25 percent, respectively. Vacancy rates for industrial properties peaked around 5.5 percent, and those of multifamily units reached nearly 10 percent during this period.

-

4

In certain office categories, current vacancy rates are higher than in the 1980s. For example, vacancy rates among Class A offices that are mostly located in central business districts stood at 19.5 percent in 2023:Q4, higher than the 18 percent peak in the 1980s. According to CBRE, these elevated vacancies for Class A offices are concentrated in the Class A-minus segment constructed mostly during the overbuilding phases of the 1980s and 1990s, suggesting a link between drivers of ongoing strains and the previous crises.

-

5

We use Texas as a representative state for the Southwest because it is the largest state in the region and was most adversely affected by the downturn in the energy sector (FDIC 1997).

-

6

Military spending declined with the end of the Cold War, the finance sector reeled from the effects of the stock market crash in October 1987, and the computer-manufacturing industry contracted because of heightened competition from Silicon Valley (FDIC 1997; Temple 2014).

-

7

The Economic Recovery Tax Act (ERTA) of 1981 altered the rules around depreciation of buildings in ways that boosted the after-tax return on CRE properties relative to other financial and real assets, especially in the early years of investment. The new legislation allowed investors in commercial property to depreciate a building at an accelerated rate over a mere 15 years compared with 40 years under the previous legislation. Financial deregulation boosted competition among banks and other financial institutions in consumer and business loans and increased their cost of funds, thereby inducing them to expand their footprint in nonresidential CRE lending. The Depository Institutions Deregulation and Monetary Control Act of 1980 (DIDMCA) began to phase out interest rate ceilings and eased net worth requirements for savings and loans institutions, which diluted their capital standards relative to commercial banks. In addition, the Garn St. Germain Act further eased capital standards and allowed savings and loans institutions to engage in CRE and commercial and industrial lending. This legislation unlocked substantial funds that were set aside exclusively to finance residential mortgages for use in CRE lending and that were subject to fewer safety and soundness regulations. Developments outside the banking industry further pushed banks to increase their real estate portfolios—firms increasingly turned to commercial paper and away from bank loans to meet their funding needs, which led banks to consider CRE loans as an alternative revenue stream (Post, Schoenbeck, and Payne 1980).

-

8

The Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) of 1989 introduced more stringent examination of banks and savings and loans, tightened capital adequacy standards for savings and loans, and introduced restrictions on the composition of their assets. In addition, the legislation introduced stricter standards for the appraisal of real estate, which previously had likely supported some inflated valuations (FDIC 1997). In 1990, risk-based capital standards were introduced and further codified under the Federal Deposit Insurance Corporation Improvement Act (1991), which specified capital ratios for “well-capitalized” institutions (Flannery and Rangan 2008).

-

9

We exclude banks from other states that also experienced CRE-related distress in this period to estimate the charge-off rates that might have prevailed absent large economic shocks. Northeastern states in our analysis consist of New York, Connecticut, Massachusetts, Rhode Island, and New Hampshire. Southwestern states besides Texas consist of Louisiana, Oklahoma, Colorado, and Wyoming (included in this group because its economy and banking sector were adversely affected by the energy price collapse of the mid-1980s). Our segments are based on a data-driven exercise in which we identify the states that persistently had the highest share of nonperforming real estate loans over a five-year period. The Southwestern states are identified from this exercise based on the period 1985–90, and the Northeastern states are identified when we shift the window to 1990–95.

-

10

We evaluate segments based on counties rather than cities to facilitate mapping between population data from the U.S. Census Bureau and data on branch locations from the Summary of Deposits.

-

11

We derive projected charge-off rates for the 2024–28 period using the following steps. First, we evaluate the difference in charge-off rates between banks exposed to each shock and their corresponding benchmark group for a five-year period since the onset of the crisis in the historical sample. For instance, for the Texas scenario, we consider the difference in charge-off rates between banks headquartered in Texas and those headquartered in other states excluding the Northeast and other Southwestern states over the period 1986–1990. Second, we add this five-year series of incremental charge-off rates to the observed charge-off rates for banks with concentrations in large counties as of year-end 2023. We thereby obtain projections for the period 2024–29. We repeat the exercise for the remaining two stressed historical and benchmark segments.

-

12

For the subset of banks that are subject to stress tests, supervisory loan level data are available. Glancy and Kurtzman (2024) use this data to find that loans to larger properties located in central business districts with scope for remote work are more likely to become delinquent. This is consistent with the types of stress we outline and aim to identify by focusing on exposure to large counties.

-

13

The global financial crisis also resulted in large losses in banks’ CRE portfolios. However, the shock that provoked that crisis arose from credit risks and financial innovation in residential rather than CRE markets. The crises of the 1980s and 1990s permits us to isolate the effects of specific CRE-related shocks such as those in Texas and the Northeast.

-

14

Banks expect lower default rates on other categories of CRE loans relative to loans against office properties (Marsh and Pandolfo 2024).

Publication information: Vol. 109, no. 8

DOI: 10.18651/ER/v109n8SharmaLaliberte

References

Boyle, Matthew. 2024. “Empty Offices Risk Wiping Out $250 Billion in Commercial Property Value.” Bloomberg, June 27.

Balla, Eliana, Laurel C. Mazur, Edward Simpson Prescott, and John R. Walter. 2019. “A Comparison of Community Bank Failures and FDIC Losses in the 1986–92 and 2007–13 Banking Crises.” Journal of Banking & Finance, vol. 106, pp. 1–15. Available at External Linkhttps://doi.org/10.1016/j.jbankfin.2019.04.005

Bernanke, Ben S., Cara S. Lown, and Benjamin M. Friedman. 1991. “The Credit Crunch.” Brookings Papers on Economic Activity, vol. 1991, no. 2, pp. 205–247. Available at External Linkhttps://doi.org/10.2307/2534592

Cole, Rebel A., and Jeffery W. Gunther. 1995. “Separating the Likelihood and Timing of Bank Failure.” Journal of Banking & Finance, vol. 19, no. 6, pp. 1073–1089. Available at External Linkhttps://doi.org/10.1016/0378-4266(95)98952-M

FDIC (Federal Deposit Insurance Corporation). 2024. “2024 Risk Review.”

———. 1997. “FDIC History of the Eighties: Lessons for the Future (Volume 1).”

Flannery, Mark J., and Kasturi P. Rangan. 2008. “What Caused the Bank Capital Build-Up of the 1990s?” Review of Finance, vol. 12, no. 2, pp. 391–429. Available at External Linkhttps://doi.org/10.1093/rof/rfm007

Garner, C. Alan. 2008. “Is Commercial Real Estate Reliving the 1980s and Early 1990s?” Federal Reserve Bank of Kansas City, Economic Review, vol. 93, no. 3, pp. 89–115.

Glancy, David, and Robert Kurtzman. 2024. “Determinants of Recent CRE Delinquency: Implications for the Banking Sector.” Board of Governors of the Federal Reserve System, Finance and Economics Discussion Series, August. Available at External Linkhttps://doi.org/10.17016/FEDS.2024.072

Glancy, David, and J. Christina Wang. 2023. “Lease Expirations and CRE Property Performance.” Federal Reserve Bank of Boston, Research Department Working Papers, no. 23-10. Available at External Linkhttps://doi.org/10.29412/res.wp.2023.10

Glancy, David, John R. Krainer, Robert J. Kurtzman, and Joseph B. Nichols. 2022. “Intermediary Segmentation in the Commercial Real Estate Market.” Journal of Money, Credit and Banking, vol. 54, no. 7, pp. 2029–2080. Available at External Linkhttps://doi.org/10.1111/jmcb.12889

Gupta, Arpit, Vrinda Mittal, and Stijn Van Nieuwerburgh. 2022. “Work from Home and the Office Real Estate Apocalypse.” National Bureau of Economic Research, working paper no. 30526, September. Available at External Linkhttps://doi.org/10.3386/w30526

Hendershott, Patric H., and Edward J. Kane. 1992. “Causes and Consequences of the 1980s Commercial Construction Boom.” Journal of Applied Corporate Finance, vol. 5, no. 1, pp. 61–70. Available at External Linkhttps://doi.org/10.1111/j.1745-6622.1992.tb00482.x

Hirtle, Beverly, Anna Kovner, James Vickery, and Meru Bhanot. 2016. “Assessing Financial Stability: The Capital and Loss Assessment under Stress Scenarios (CLASS) Model.” Journal of Banking & Finance, vol. 69, pp. S35–S55. Available at External Linkhttps://doi.org/10.1016/j.jbankfin.2015.09.021

Kaiser, Ronald. 1997. “The Long Cycle in Real Estate.” Journal of Real Estate Research, vol. 14, no. 3, pp. 233–257. Available at External Linkhttps://doi.org/10.1080/10835547.1997.12090911

Kroszner, Randall S., and Philip E. Strahan. 1999. “What Drives Deregulation? Economics and Politics of the Relaxation of Bank Branching Restrictions.” Quarterly Journal of Economics, vol. 114, no. 4, pp. 1437–1467. Available at External Linkhttps://doi.org/10.1162/003355399556223

Marsh, W. Blake, and Jordan Pandolfo. 2024. “Banks’ Commercial Real Estate Risks Are Uneven.” Federal Reserve Bank of Kansas City, Economic Bulletin, April 18.

Metcalfe, Todd, Anthony Spinelli, and Thomas LaSalvia. 2024. “What Will Be the Impact on Office Demand from WFH?” Moody’s CRE Insights, June 27.

Monte, Ferdinando, Charly Porcher, and Esteban Rossi-Hansberg. 2023. “Remote Work and City Structure.” National Bureau of Economic Research, working paper no. w31494, July. Available at External Linkhttps://doi.org/10.3386/w31494

Peek, Joe, and Eric Rosengren. 1995. “The Capital Crunch: Neither a Borrower nor a Lender Be.” Journal of Money, Credit and Banking, vol. 27, no. 3, pp. 625–638. Available at External Linkhttps://doi.org/10.2307/2077739

Post, Mitchell A., Michael A. Schoenbeck, and Joyce A. Payne. 1992. “The Evolution of the U.S. Commercial Paper Market since 1980.” Board of Governors of the Federal Reserve System, Federal Reserve Bulletin, vol. 78, no. 12, pp. 879–891.

Rappaport, Jordan. 2024. “Downtown Office Use Has Declined, but Some Metropolitan Areas Are Faring Better than Others.” Federal Reserve Bank of Kansas City, Economic Bulletin, March 25.

Temple, James. 2014. “Tech’s Lost Chapter: An Oral History of Boston’s Rise and Fall, Part One.” Vox, December 9.

The authors thank George French and Lee Davison from the FDIC for their input and advice in identifying historical call report variables used in the "History of the Eighties." They thank Andrew Boettcher from the Federal Reserve Bank of Chicago for helpful discussions on ongoing developments in CRE.