Introduction

China has exceeded every other country in the world in adopting mobile payments at the point of sale (POS). For the majority of these payments, a quick response (QR) code is used to transmit payment information. China’s three neighboring markets, Japan, Singapore, and Hong Kong, are lagging behind despite being among the earliest adopters of contactless chip-based payments for mass transportation. These three markets, however, have been undergoing several initiatives facilitating QR code-based mobile payments more recently. This Briefing will describe the initiatives and discuss whether new mobile payments address pain points of key parties in the mobile payment ecosystem.

Market environments in Japan, Singapore, and Hong Kong relative to China

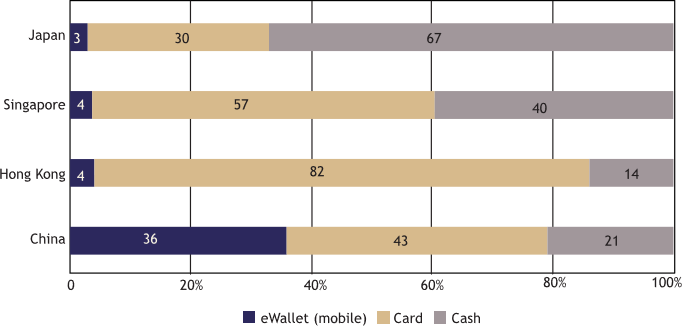

In Japan, Singapore, and Hong Kong, contactless chip-based payments—either via a mobile phone or a card—have been popularly used for mass transportation for more than a decade. These payments have also been used at vending machines and some convenience stores but have not been widely used at retail stores._ According to WorldPay’s Global Payments Report, mobile payments accounted for only 3 or 4 percent of POS spending in Japan, Singapore, and Hong Kong in 2017, in sharp contrast to China’s 36 percent (Chart). In Japan, cash accounts for more than two-thirds of POS spending, while in Hong Kong, cards account for the vast majority of spending (82 percent). Singapore is in-between.

Chart: Payment Method Share in Value at POS in 2017

Source: WorldPay (2018) “Global Payments Report: The art and science of global payments.”

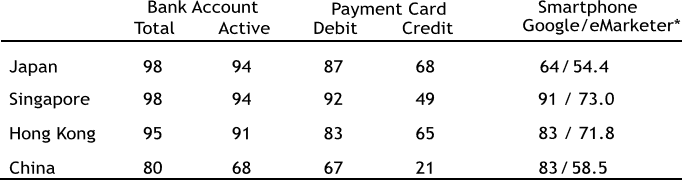

The difference in the popularity of mobile payments at the POS across China and its three neighboring markets may be partially attributable to differences in consumers’ ownership of bank accounts, credit and debit cards, and smartphones. China’s ownership rates of bank accounts and credit and debit cards are significantly lower than those of Japan, Singapore, and Hong Kong; however, China’s smartphone ownership rate is not much lower than those of Singapore and Hong Kong and is indeed higher than that of Japan (Table). The statistics suggest that mobile payments are the only alternative to cash for many Chinese consumers, whereas consumers in the other markets may have several non-cash payment methods. Limited payment methods, coupled with a relatively high rate of smartphone ownership, led China to leapfrog the use of cards—going straight from cash to mobile payments—once mobile wallets were introduced.

Table: Consumer Ownership Rate (%) in 2017

*: For smartphone ownership rates, two different sources are used.Sources: World Bank’s Global Findex Database 2017, Google Consumer Barometer Trended Data, eMarketer “Top 25 Countries, Ranked by Smartphone User Penetration, 2016-2021,” “Smartphone Users and Penetration in Japan, 2017-2022” and “Smartphone User Penetration in China, by Age, 2014-2020.”

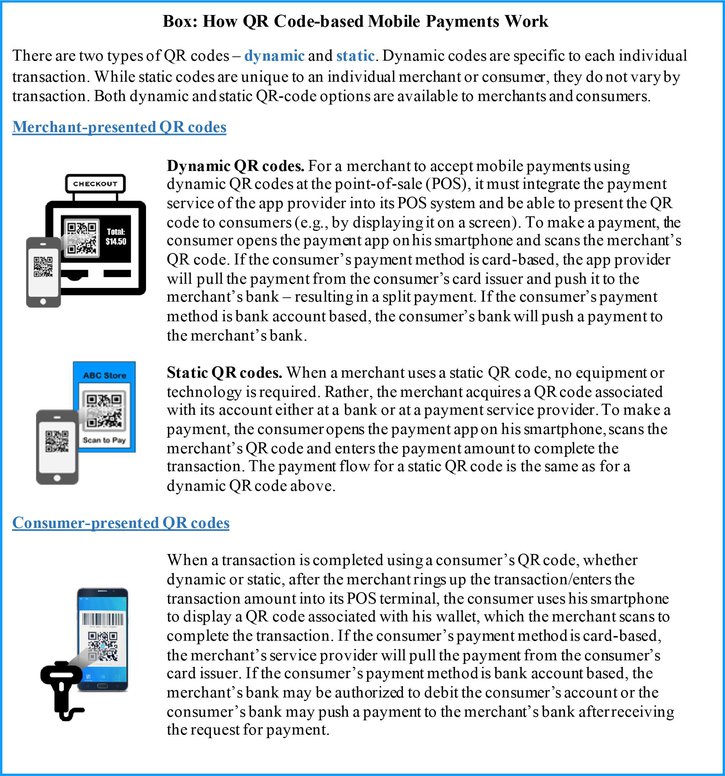

Several features of mobile wallets in China may also contribute to the popularity of mobile payments._ First, many mobile wallets have stored-value capability—in other words, customers prefund the mobile wallet before making payments—and offer flexible funding options, including bank accounts, cards, cash, and fund transfers from family, friends, and other third parties. These options enable the unbanked and underbanked to easily access mobile payments. Second, two leading mobile wallets, Alipay and WeChat Pay, offer a variety of functions that go beyond making payments at the POS and transferring funds. By leveraging their respective dominance and sizable customer bases in the e-commerce and social network markets, Alipay and WeChat Pay have attracted other businesses to offer services such as ride hailing and hotel booking through the mobile wallet apps, which in turn attract more consumers. Third, most mobile wallets in China use QR codes to transmit payment information in a few different ways. A merchant can present a QR code for the consumer to scan or the consumer can present a QR code on a mobile payment app for the merchant to scan (see Box). A QR code presented by a merchant or a consumer can be either static or dynamic. Merchants can accept QR code-based mobile payments easily, especially those using merchant-presented static QR codes or consumer-presented static or dynamic QR codes, because they need little or no equipment. In contrast, accepting card payments or contactless chip-based mobile payments requires merchants to have equipment such as a POS terminal and a card- or chip-reader.

Recent mobile payment initiatives in Japan, Singapore, and Hong Kong

Japan

Although Japan was one of the first countries to introduce contactless chip-based mobile payments, QR code-based mobile payment apps have become more prominent in the last few years. In 2004, NTT DoCoMo, a major mobile carrier in Japan, introduced mobile payments using FeliCa, a contactless integrated circuit chip; however, the use of such payments has been limited to mass transportation and surrounding convenience stores. QR code-based mobile payment apps have emerged in the past several years, and more than 20 apps currently exist. Many of these apps are offered by nonbanks, such as e-commerce platforms, social media platforms, mobile carriers, retailers, and other fintechs. The industry’s shift from chip-based to QR code-based mobile payments may have become evident when NTT DoCoMo announced its QR code-based mobile payment service in January 2018.

In addition to nonbanks, banks have also started offering QR code-based mobile payment apps. Two noteworthy initiatives are Mizuho Bank’s J-Coin Pay and Mitsubishi UFJ Financial Group (MUFG) Bank’s Coin. In March 2019, Mizuho Bank introduced the J-Coin Pay app in cooperation with about 60 other banks. The J-Coin Pay app is a digital currency platform that allows consumers to move funds between their J-Coin Pay accounts and deposit accounts, make payments using QR codes, and transfer funds among J-Coin Pay accountholders. In April 2019, MUFG Bank announced its plan to roll out MUFG Coin, a blockchain-based digital currency platform, by the end of 2019. While detailed product features are not yet available, MUFG Coin’s use cases for retail payments appear to be similar to those of J-Coin Pay.

Banks have three clear motivations for introducing these new products. First, they help banks support the Japanese government’s “cashless vision,” which includes increasing the share of card and e-money payments in the household final consumption expenditure from about 20 percent in 2017 to 40 percent in 2025. Japan is one of the most cash-dependent developed countries: while Japanese consumers and businesses frequently use credit transfers from their bank accounts, they still depend heavily on cash at the POS. Japanese consumers’ strong preference for cash is partly explained by their high trust in cash due to fewer counterfeit currencies and lower risk of theft relative to other countries. Second, shifting payment volume away from cash allows banks to reduce the cost of operating and maintaining ATMs. According to Mizuho Financial Group, the estimated cost reduction in the banking sector would be around 1 trillion yen ($9 billion). Third, by playing an active role as mobile app providers, banks can collect data on their customers’ transactions. Combined with other consumer data, the transaction data can be used by banks and their business customers to better market to and serve consumers.

Both banks and nonbanks consider QR code-based mobile payments to have advantages in achieving ubiquitous adoption relative to other digital payments. For example, merchants may be more willing to accept QR code-based mobile payments than other digital payments. As mentioned above, QR code-based mobile payments require little or no equipment for merchants. The ongoing cost of accepting QR code-based mobile payments may also be lower: many of the QR code-based mobile payment apps use prefunded or bank account-based payments, which charge merchants lower transaction fees than card payments. In addition, merchants may be able to attract tourists, especially from China, who use QR code-based mobile payments such as Alipay and WeChat Pay.

In Japan, initiatives to promote QR code-based mobile payments are driven by the private sector; however, public authorities influence these initiatives. As mentioned, the government—specifically, the Ministry of Economic, Trade, and Industry (METI)—set a “cashless vision” for the country._ METI recommended setting up a neutral entity composed of members of the industry, academia, and the government to advance the cashless vision, and as a result, the Payments Japan Association was established in July 2018. Since its launch, the association has engaged in various projects, one of which is QR code standardization._ The Financial Services Agency (FSA) has been facilitating digital innovation in the financial sector by transforming Japan’s regulatory framework._ For example, the FSA enforces the cryptocurrency regulation requiring any cryptocurrency exchange entity to register with the FSA. In addition, the FSA introduced an open application programming interface (API) “mandatory effort” rule, which encourages banks to enable at least one fintech third party provider to access the banks’ systems via API connections. These regulatory transformations facilitate competition in the financial sector, including between banks and nonbanks.

Singapore

In Singapore, chip-based card payments were introduced much earlier than in Japan, but mobile payments at the POS were not introduced until the early 2010s. Since the mid-1990s, a few different chip-based cards have been popular, especially for transportation. In 1995, Network Electronic Transfers (NETS), a major electronic payment service provider founded by a consortium of banks, introduced CashCard, which was adopted as the sole payment method for the toll road payment system in 1997. In 2001, the Land Transport Authority introduced EZ-Link as a speedier payment method for public transportation. In 2009, NETS introduced FlashPay—a contactless payment for public transportation, tolls, and other retail stores—in response to a government initiative to make various multipurpose, stored-value card payment schemes interoperable. While contactless chip technology in cards improved over time, mobile payments were not introduced until 2012, when EZ-Link, in cooperation with mobile carriers, started offering near field communication (NFC) subscriber identity module (SIM) cards installed in NFC-enabled mobile phones._ Initially, EZ-Link’s NFC-based mobile payments were used only at retail stores, but since 2016, they have been used for public transportation as well.

From 2012 to 2014, EZ-Link mobile payments remained an anomaly; the payment industry was not very active in offering mobile payment apps. In March 2014, the Association of Banks of Singapore introduced the Fast and Secure Transfers (FAST) system in response to Intelligent Nation 2015 (iN2015), a 10-year masterplan launched by the government that included an initiative to develop next-generation electronic payment solutions. The FAST system is a 24/7 real-time payment system that leverages smartphones to enable instant payments across bank accounts and between consumers and businesses. As the iN2015 initiative was coming to a close, the government launched the Smart Nation Initiative (SNI) in November 2014, which included a plan to increase the adoption of electronic payments. Part of the plan was to roll out instant payments in four waves: person-to-person (P2P) payments, business-to-consumer (B2C) payments, business-to-business (B2B) payments, and finally consumer-to-business (C2B) payments that include payments at the POS._

Immediately after the FAST implementation, the industry started offering mobile payment apps. Along with the SNI rollout plan, some of the earlier mobile payment apps initially had only P2P capability but later expanded to mass transportation and POS._ Other mobile payment apps were mobile wallets that allowed both P2P and POS payments when they were introduced._ Today, more than 40 mobile payment apps are available, which vary by capability, funding source, and technology used to transmit payment information, including NFC and QR codes.

The proliferation of mobile QR-code wallet options created a problem for merchant acceptance. Although QR code-based mobile wallets are easier for merchants to accept than NFC-based mobile wallets, accepting QR codes was not convenient initially: each mobile wallet had its own distinct code, which cluttered merchants’ storefronts. To address this merchant pain point, NETS participants created NETSPay, which unified the separate QR codes of participating banks into a single code. Ultimately, the industry as a whole addressed the problem. In 2018, an industry task force co-led by the Monetary Authority of Singapore (MAS) launched the Singapore Quick Response (SGQR) Code, a single common QR code standard that combines multiple payment QR codes into a single SGQR label, making QR code-based mobile payments simple for merchants as well as for consumers. Upon launch, SGQR was adopted by more than 20 payment schemes including NETSPay._

Advancements in facilitating mobile payments continue. Late in 2018, MAS announced plans to open up the FAST system to allow direct access to nonbanks so that their e-wallets can interoperate with bank accounts._ This change will allow customers to move funds instantly between their mobile wallets and bank accounts. Furthermore, allowing open access to the FAST system might create value-added services as providers compete, thus further advancing Singapore’s cashless push.

Hong Kong

Similar to Singapore, Hong Kong introduced contactless card payments in the mid-1990s and mobile payments at the POS in the mid-2010s. In 1997, a joint venture formed by major transit companies in Hong Kong launched the Octopus card to collect fares for mass transit systems. Since then, the card’s uses have expanded to vending machines, parking meters and retail stores at which small-value payments are frequently made. Today, the Octopus card is still one of the city’s most popular payment methods. In 2013, the city began improving its NFC mobile payment infrastructure, and the private sector introduced several NFC-based, stored-value mobile wallets. However, these wallets were not widely adopted because they were less convenient than existing payment methods, such as the Octopus card and credit and debit cards.

In 2016, the private sector again began to introduce both NFC- and QR code-based mobile payments. For example, Octopus launched a mobile payment app called O! ePay, which was initially limited to P2P payments and to top-up Octopus cards. The app later expanded to allow online payments and QR code-based payments at the POS. Apple Pay, which is an NFC-based mobile wallet, also launched in Hong Kong in 2016. Other mobile wallet providers, including Google (Android Pay), WeChat Pay HK, and Alipay HK, entered the market soon after.

In addition to the private sector, the public sector has been playing important roles in facilitating the adoption of mobile payments, especially QR code-based mobile payments. The Hong Kong government, which envisions the city becoming a smart city where residents can “enjoy convenient mobile payments anytime and anywhere,” proposed the development of a Faster Payment System (FPS) and a common QR code standard by 2018._ The Hong Kong Monetary Authority (HKMA) played a leading role in the implementation; in September 2018, the HKMA launched the FPS and the Hong Kong Common QR Code (HKQR) app._ Similar to Singapore’s FAST system, Hong Kong’s FPS is a 24/7 real-time payment system enabling instant payments for P2P, B2C, B2B and C2B._ Unlike Singapore’s FAST system, FPS has been open to nonbanks from its implementation. The HKMA allows licensed stored value facilities (SVFs) to access the FPS as clearing participants; to date, there are 10 participating SVFs, including four mobile wallet operators._ As a result, these mobile wallets have real-time payment capability, which will benefit both merchants and consumers. Merchants may no longer have to wait days to receive funds, and consumers can instantly top-up their accounts and receive refunds. The HKQR app, which enables merchants to combine the QR codes of different payment schemes into one, specifically addresses a pain point of merchants—the hassle of having to display multiple QR codes. Currently, 12 schemes are participating or have announced participation in the HKQR app, including card networks, FPS, and mobile wallet operators.

These public sector initiatives have encouraged new private-sector developments. Most notably, Alipay HK entered into a partnership with the Mass Transit Railway (MTR) in November 2018 to implement a QR code fare payment method at 91 MTR stations by mid-2020. By mid-2021, this QR code fare payment method will also become available for users of a few other mobile wallets, such as WeChat Pay HK, TNG Wallet and UnionPay.

Can new mobile payments address pain points?

In Japan, Singapore, and Hong Kong, QR code-based mobile payments are being promoted by both banks and nonbanks and supported by their respective governments either directly or indirectly. While QR code-based mobile payments will likely address many service providers’ and merchants’ pain points, it is unclear whether they will entice consumers.

If QR code-based mobile payments achieve ubiquitous adoption, as expected by public authorities and private-sector payment service providers, those payments benefit banks and nonbanks. With QR code-based mobile payments substituting for cash, banks will be able to reduce costs related to cash services. This cost reduction will be particularly large in high cash use-countries such as Japan and Singapore, and may outweigh the potential cannibalization of the banks’ revenue from card payments. Moreover, to the extent QR code-based mobile payments displace cash, they will increase the volume of consumer transaction data available to banks and nonbanks. As commerce increasingly relies on detailed data about consumers, access to detailed transaction data may help banks and nonbanks better understand their customers’ behaviors and needs and thereby stay competitive. Furthermore, in Singapore and Hong Kong, the faster payment infrastructure is accessible by both bank and nonbank QR code-based mobile wallet operators, enabling these operators to offer better, more competitive services that are speedier, safer, and more convenient than other digital payments.

QR code-based mobile payments will address a few of merchants’ pain points when accepting digital payments. First, as discussed previously, the cost of accepting QR code-based mobile payments will likely be lower than the cost of accepting other digital payments such as NFC-based mobile payments and card payments. Second, while static QR codes pose some security risk—for example, fraudsters could replace a static QR code at a storefront with a fraudulent code that directs payment to their account—dynamic QR codes are unique to each transaction and thus as secure as other digital payments such as NFC-based mobile payments. Third, QR code-based mobile payments can take advantage of instant payments, allowing merchants to receive funds, as well as send refunds to their customers, more quickly than other digital payments.

While QR code-based mobile payments may provide more benefits to merchants than other digital payments, whether they also provide more benefits than cash depends on the implementation. Since merchants in Japan and Singapore handle cash payments very efficiently, QR code-based mobile payments need to be at least as efficient as cash or provide additional benefits to entice merchants to accept those payments. The common QR code standard helps improve efficiency, especially when merchant-presented QR codes are used. In addition, merchants may find their ability to offer specific rewards and promotions to their customers via QR code-based mobile wallets beneficial. However, due to the current fragmentation of QR code-based mobile wallets, merchants may not experience these benefits, especially when consumer-presented QR codes are used. Fragmentation may impede merchants from achieving efficiency if the merchants need to take additional steps to route payments to different mobile wallets. Furthermore, fragmentation may reduce merchants’ ability to collaborate with multiple mobile wallet providers, and thus result in merchants’ inability to extend rewards or promotions to many of their customers. These problems with fragmentation, however, may diminish if the industry undergoes consolidation.

To consumers, QR code-based mobile payments may provide superior, or at least similar, features to other digital payments; however, whether QR code-based mobile payments can entice consumers in Japan, Singapore, and Hong Kong to switch from cash is uncertain. Japanese consumers, for example, prefer cash for several reasons: high trust in cash, easy ATM access, faster speed and accuracy of cash transactions at the POS, and lack of ubiquitous acceptance of card and other digital payments by merchants. For QR code-based mobile payments to match the benefits of cash, public authorities and private-sector service providers may need to further coordinate their efforts, for example, to address the fragmentation problems that impede ubiquitous merchant acceptance of QR code-based mobile payments.

Even if QR code-based mobile payments can match the benefits of cash, consumers still may not be enticed to switch. An important contributing factor to China’s successful adoption of mobile payments at the POS is that AliPay and WeChat Pay integrated many different services into their mobile wallets. If QR code-based mobile payments at the POS in Japan, Singapore, and Hong Kong are stand-alone platforms, these platforms may not improve consumers’ overall digital commerce experience. As a result, QR-code based mobile payments may not achieve a high level of consumer adoption.

Endnotes

-

1

Examples include Mobile Suica in Japan, EZ link in Singapore, and Octopus card in Hong Kong.

-

2

In this article, a mobile wallet is defined as an app that stores payment account credentials and/or value on a mobile device enabling users to pay for goods and services digitally by using their phones.

-

3

See METI press release at: https://www.meti.go.jp/english/press/2018/0411_002.html

-

4

See METI press release at: https://www.meti.go.jp/english/press/2019/0329_001.html

-

5

See FSA’s laws and regulations at: https://www.fsa.go.jp/en/laws_regulations/index.html

-

6

DBS One.Tap, another NFC-based mobile payments, was introduced in 2012 but discontinued in 2015.

-

7

To facilitate P2P and B2C payments, the industry launched PayNow in 2017. The platform enables instant P2P and B2C payments simply by entering a mobile or personal identification number. In 2018, the industry introduced PayNow Corporate to allow businesses and government agencies to pay and receive funds instantaneously using a Unique Entry Number.

-

8

Examples include the Development Bank of Singapore’s (DBS) PayLah! and Oversea-China Banking Corporation’s (OCBC) PayAnyone.

-

9

Examples include Singtel’s Dash and United Overseas Bank’s (UOB) Mighty.

-

10

See MAS media release at: http://www.mas.gov.sg/~/media/resource/news_room/press_releases/2018/Annex%20B%20%20SGQR%20Taskforce%20Composition.pdf

-

11

By the end of 2019, nonbank e-wallet providers will get access to FAST.

-

12

The Smart City Blueprint is available at: www.smartcity.gov.hk

-

13

FPS was introduced by the HKMA and is operated by the Hong Kong Interbank Clearing Limited.

-

14

Unlike many real-time payment systems that allow credit-push payments only, Hong Kong’s FPS enables both credit-push and debit-pull payments.

-

15

The list of FPS participants is available at: https://fps.hkicl.com.hk/eng/fps/about_fps/participant.php

The views expressed in this newsletter are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Kansas City or the Federal Reserve System.