Oil prices dropped sharply in the second half of 2014, causing energy companies to make significant cuts in their 2015 capital spending budgets and, in some cases, lay off workers. Through April 2015, Oklahoma oil and gas jobs already have declined more than 10 percent from their late-2014 peak. Previous episodes of large declines in the price of oil when Oklahoma’s energy sector was large have been accompanied by declines in overall state employment and several years of weak job growth. This edition of The Oklahoma Economist updates the current oil downturn and its effect on the broader state economy in 2015 and looks at what may lie ahead.

Why would oil difficulties spread to other industries?

The previous edition of The Oklahoma Economist compared state employment trends in six past periods of large declines in oil prices since 1980. In each case, oil and gas jobs in the state fell sharply while total state employment varied. But in the three cases when oil and gas comprised a much larger share of state economic activity—1982, 1985 and 2008—total Oklahoma employment fell by at least 2 percent in the following year and remained below its previous peak for at least three years. In each case, employment fell not only in the oil and gas sector, but also in other sectors.

There are several reasons why difficulties in Oklahoma’s oil and gas sector could spill over to other industries and the broader state economy. Most directly, the oil and gas sector purchases and uses many goods and services from other industries, often from nearby companies. As energy activity falls, so does demand for these goods and services, which can result in cutbacks among their producers. For example, a variety of manufactured goods are used in drilling and completing wells, from pipe to machinery to fracking fluids. Oil and gas firms also use services provided by truck and rail transportation, legal and accounting firms and others.

In addition, as workers in the oil and gas sector lose jobs, have pay reduced, or even just fear a loss of employment or income, they may reduce their spending, hurting local economies and industries like retail trade, housing and hospitality. This negative effect is typically larger for oil and gas than other sectors because wages for oil and gas jobs generally are much higher. Similarly, income taxes and sales taxes are affected at both the state and local levels when oil and gas workers lose jobs or have their pay reduced. Declines in these revenue streams can lead to cuts in government services and employment.

To be sure, there can also be positive spillovers to other industries when oil prices fall. For example, petroleum-based products are an input for many manufacturers and transportation firms, so their bottom lines can be helped by lower oil prices. Likewise, consumers benefit from lower gasoline prices when oil prices fall, freeing up more of their budget to make other types of purchases or to invest.

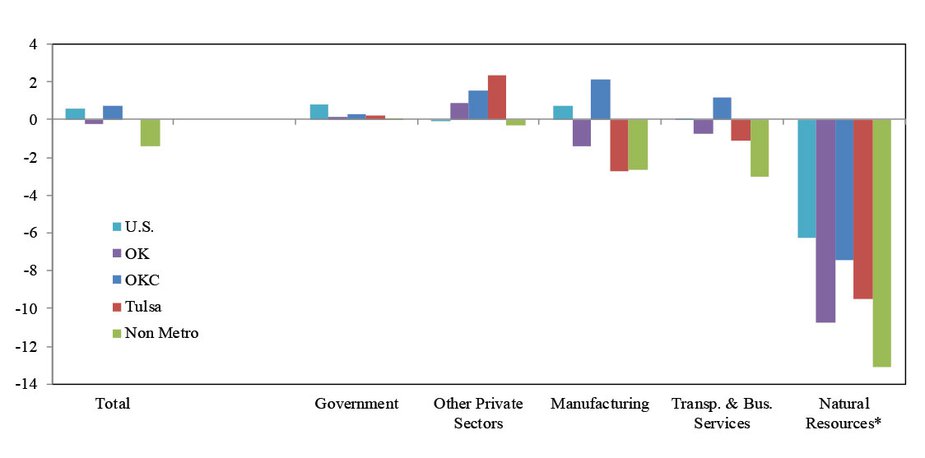

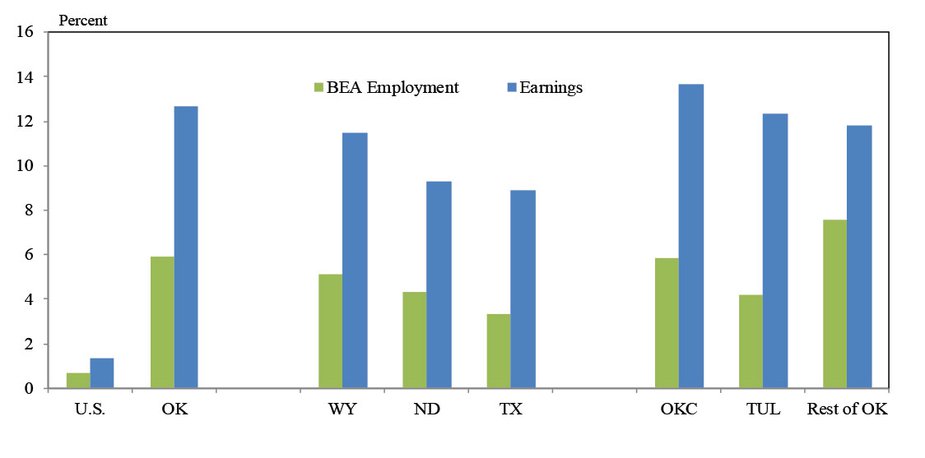

But as Oklahoma history has shown, the size of the oil and gas sector seems to determine whether positive or negative spillovers prevail in the overall state economy. Just prior to the current oil downturn, the sector was similar to the early 1980s and late 2000s in terms of worker earnings, though employment was somewhat smaller than the 1980s. In 2013, oil and gas jobs accounted for 6 percent of Oklahoma employment, similar to other energy states such as Wyoming and North Dakota, somewhat larger than Texas and about 10 times more than the sector’s share of national employment (Chart 1). And since oil and gas jobs pay more than twice the average across all jobs, the sector’s share of worker earnings in Oklahoma and other energy states is considerably higher.

Chart 1: Oil and Gas Sector Employment and Worker Earnings Share

Source: U.S. Bureau of Economic Analysis

How much negative spillover has occurred to date?

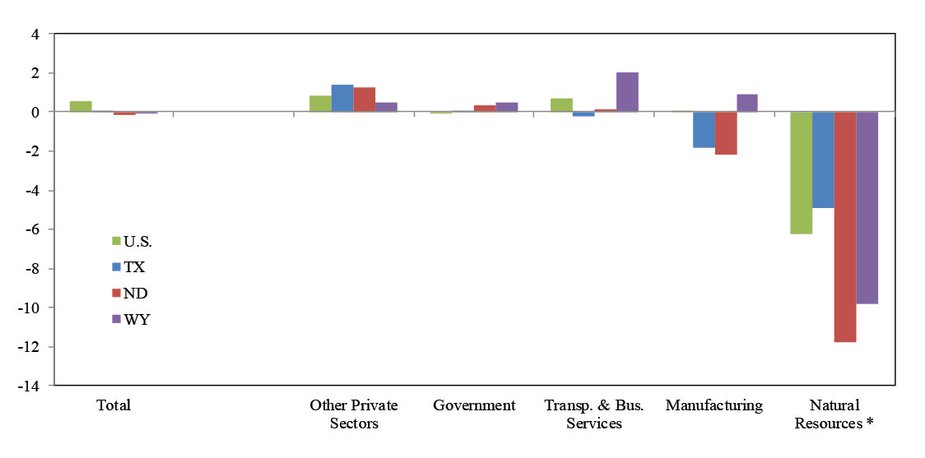

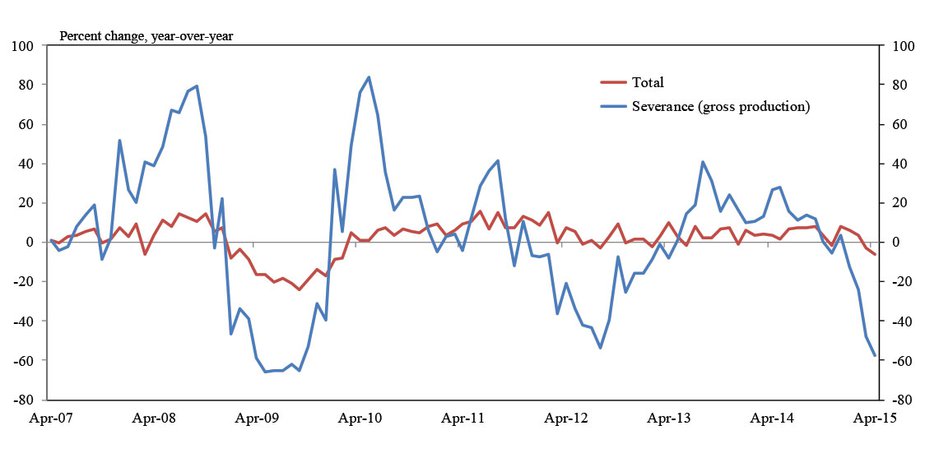

The sharp recent decline in energy activity and jobs in Oklahoma appears to be affecting other industries and overall state economic growth in 2015. Oklahoma manufacturing employment was down 1.4 percent through April, while transportation and business services jobs were off 0.7 percent (Chart 2). Together with the sharp decline in energy jobs, these losses have pulled total Oklahoma employment down by 0.2 percent from December to April. In addition, tax revenues in the state have declined. Severance tax receipts have dropped considerably, and total state tax receipts in May were 6 percent less than year-ago levels.

These negative effects in the Oklahoma economy are largely in contrast to the effect of weaker oil and gas activity on the national economy, but similar to the effect in other energy states. While energy jobs are down in virtually all states in 2015, overall national employment has continued to grow solidly. Total employment in North Dakota, Wyoming and Texas, however, is flat or down slightly since December.

Within Oklahoma, the effect has varied. The largest decline in energy jobs has been in non-metro areas, where oil and gas also comprise a larger share of the economy (Chart 3). This is likely due to a smaller effect on headquarters jobs in cities than jobs associated with rigs. Oklahoma employment outside the two major metro areas of Oklahoma City and Tulsa is down 1.4 percent since December, with sharp declines not only in the energy sector but also in manufacturing, transportation and several services sectors.

The two large metro areas have generally fared better. The Tulsa metro area has seen flat employment in 2015, as declines in energy, manufacturing and transportation jobs have been offset by increases in other sectors. Employment in the Oklahoma City metro area has grown similarly to the nation through April despite sharp job losses in oil and gas employment, as other industries continue to grow.

Chart 2: Employment Change by Industry

*Includes energy sector. Source: U.S. Bureau of Labor Statistics.

Chart 3: Employment Change by Industry

*Includes energy sector. Source: U.S. Bureau of Labor Statistics.

Is negative spillover likely to continue?

Although state employment data go only through April 2015 and state tax data generally lag by several months, other sources can provide insights into whether negative spillovers continued in May and are likely to persist. These include recent Federal Reserve business surveys, higher-frequency state labor market and energy data, and the outlook for oil prices. In general, these sources suggest the slowdown in Oklahoma’s economy could become less severe in coming months.

The Kansas City Fed’s latest quarterly energy survey, conducted in late March, found the region’s oil and gas companies plan to cut employment in 2015 by an average of 12 percent. This suggests the sector’s declining employment is likely to continue, but at a slower rate. The survey also found that oil and gas firms have been and plan to continue cutting hours, bonuses and, in some cases, wages of remaining workers. These factors may dampen local consumer spending in energy-dependent areas.

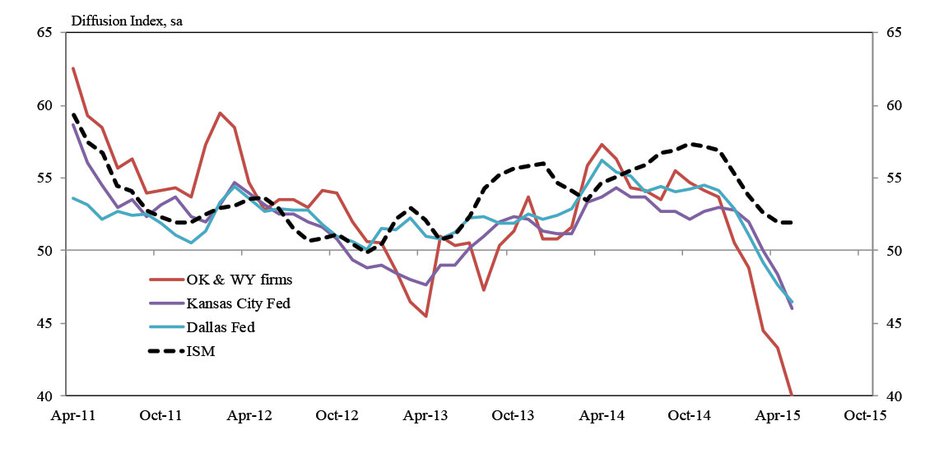

The results of the latest monthly Kansas City Fed manufacturing survey with information through May, show a larger regional factory decline than in the nation (Chart 4). While manufacturing activity across the nation has been hurt by a stronger dollar dampening exports and the recent West Coast port strike, energy-dependent areas have seen larger declines. Oklahoma and Wyoming factories in the Kansas City Fed manufacturing survey reported worse results than other states, and results of the latest Dallas Fed manufacturing survey similarly show worse results than in the nation. However, factories in Oklahoma and Wyoming expect the pace of deterioration to subside over the next six months.

Recent weekly state data suggest that the deterioration in economic conditions in Oklahoma and other energy states may be lessening. Data on new jobless claims through mid-May show that while claims remain elevated in energy states compared to the nation, the pace of new claims slowed slightly in April and May after surging in February and March, including in Oklahoma (Chart 5). Similarly, weekly data on rig counts by state through late May show some signs that drilling activity in Oklahoma is leveling off.

Chart 4: Manufacturing Survey Composite Indexes

Sources: ISM and Fed manufacturing surveys

Chart 5: New Claims for Unemployment Insurance

Source: U.S. Bureau of Labor Statistics

Looking beyond the next few months, the most important factor affecting whether the oil downturn continues to cause difficulties for Oklahoma’s economy is the future path of oil prices. Although prices remain much lower than in the first half of 2014, in April and May they rose considerably from first-quarter lows, reaching $60 per barrel. This is near the $62 price firms reported in the latest Kansas City Fed energy survey that they needed, on average, to be profitable.

But whether prices stay at or rise from current levels remains highly uncertain, and depends on many rapidly developing factors. These include: whether and how much the domestic oil supply increases as prices rise and if this results in another downshift in prices; how geopolitical events such as airstrikes in Yemen and negotiations over sanctions on Iran affect international oil supply; movements in international exchange rates; and the path of domestic and world demand for petroleum products.

Conclusion

Oil and gas activity in Oklahoma began a sharp decline in late 2014, with job cuts in the high-paying sector persisting through spring 2015. Similar to past episodes of sizable declines in oil prices when the Oklahoma energy sector is large, this downturn appears to have spilled over into other industries, including manufacturing, transportation and business services. The result has been an overall slight decline in Oklahoma jobs and tax revenues in 2015. Higher-frequency data suggest the pace of the downturn may be lessening slightly. However, the extent to which difficulties persist depends largely on the future path of oil prices, which in turn depends on many domestic and international factors.