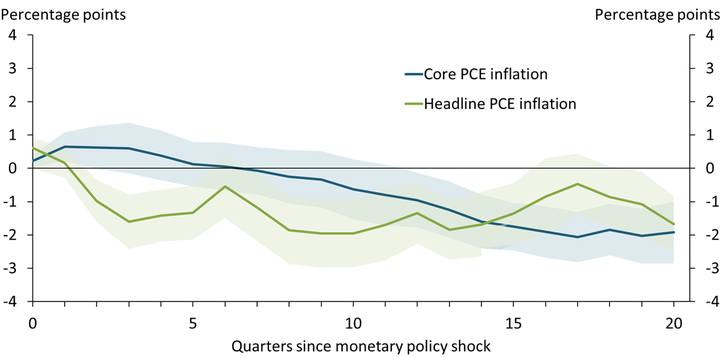

Notes: The chart shows the cumulative effect of a surprise hike in the federal funds rate, coded as a binary variable from Romer and Romer (2023), on the time path of each variable relative to the time path without a surprise hike. Monetary policy surprises are narratively identified based on historical minutes and transcripts of Federal Reserve policymaking meetings. Shaded areas represent one standard error confidence bands.

Sources: Federal Reserve Bank of Kansas City (Haver Analytics), External LinkRomer and Romer (2023), and author’s calculations.

Historic evidence since 1960 suggests that headline inflation responds to monetary policy differently from core inflation, which excludes food and energy prices. After a surprise hike in the federal funds rate, headline personal consumption expenditure (PCE) inflation declines within a year (green line), largely reflecting declines in energy and food price inflation. In contrast, core PCE inflation (blue line) takes two years to decline. The current inflation cycle follows this pattern: over the last year, core PCE inflation declined only slightly, but headline PCE inflation declined from 7.0 to 4.4 percent.

See more research from Charting the Economy.