Summary of Quarterly Indicators

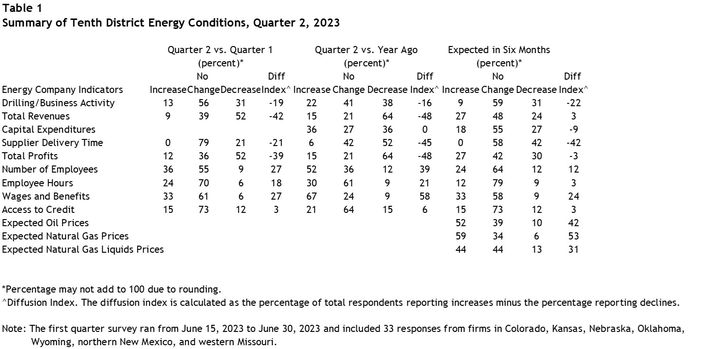

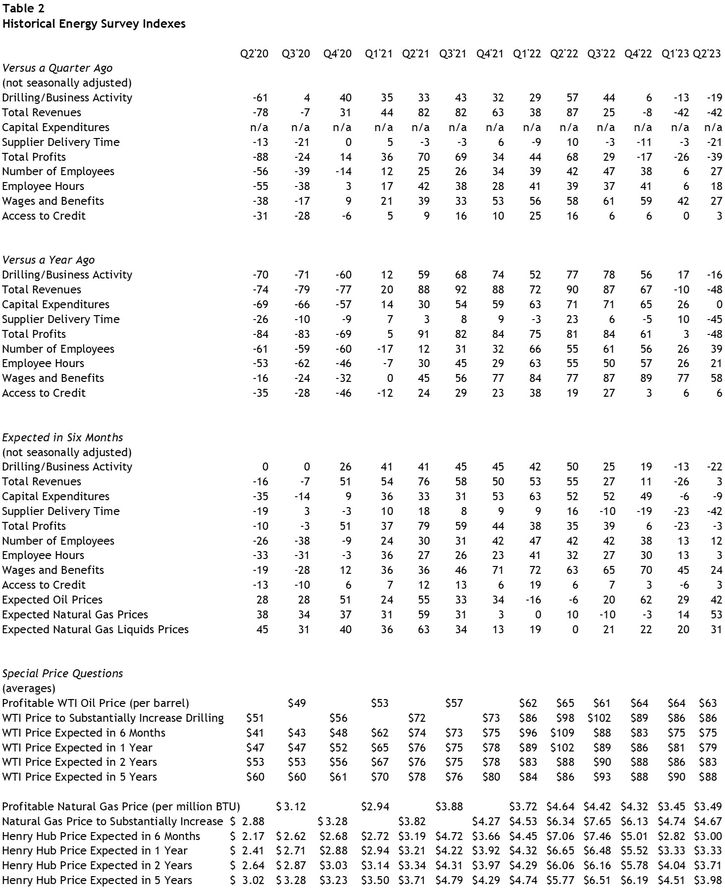

Tenth District energy activity continued to decline in the second quarter of 2023, as indicated by firms contacted between June 15th, 2023, and June 30th, 2023 (Tables 1 & 2). The drilling and business activity index decreased from -13 to -19 (Chart 1). The number of employees and employee hours indexes increased, as well as access to credit, while all other indexes decreased from previous readings. Wages and benefits cooled but remained expansionary.

Chart 1. Drilling/Business Activity Indexes

Skip to data visualization table| Quarter | Vs. a Quarter Ago | Vs. a Year Ago |

|---|---|---|

| Q2 19 | 7 | -11 |

| Q3 19 | -23 | -21 |

| Q4 19 | -48 | -50 |

| Q1 20 | -81 | -92 |

| Q2 20 | -62 | -70 |

| Q3 20 | 4 | -71 |

| Q4 20 | 40 | -60 |

| Q1 21 | 35 | 12 |

| Q2 21 | 33 | 59 |

| Q3 21 | 43 | 68 |

| Q4 21 | 32 | 74 |

| Q1 22 | 29 | 52 |

| Q2 22 | 57 | 77 |

| Q3 22 | 44 | 78 |

| Q4 22 | 6 | 56 |

| Q1 23 | -13 | 17 |

| Q2 23 | -19 | -16 |

All year-over-year indexes decreased, except the number of employees which increased moderately and access to credit which remained steady. Drilling/business activity, supplier delivery time, and total profits crossed into negative territory on a year-over-year basis, while the total revenues index declined further from -10 to -48. The number of employees and employee hours indexes remained positive.

Expectations for future activity decreased again in Q2 2023. The future drilling/business activity index fell from -13 to -22, while firms expect declines in revenues and profits to moderate in six months. Accordingly, price expectations for oil and gas picked up in the second quarter.

Summary of Special Questions

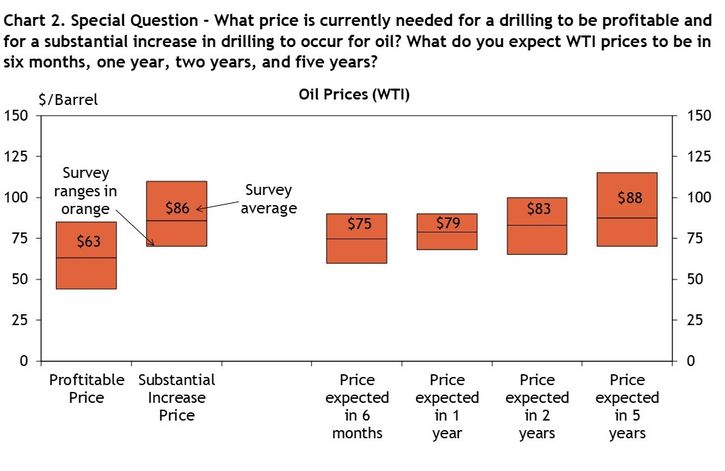

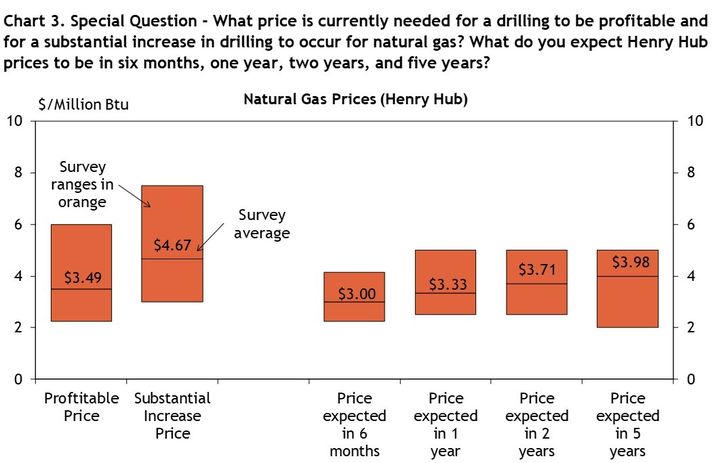

Firms were asked what oil and natural gas prices were needed on average for drilling to be profitable across the fields in which they are active. The average oil price needed was $63 per barrel (Chart 2), while the average natural gas price needed was $3.49 per million Btu (Chart 3). Firms were also asked what prices were needed for a substantial increase in drilling to occur across the fields in which they are active. The average oil price needed was $86 per barrel (Chart 2), and the average natural gas price needed was $4.67 per million Btu (Chart 3).

Firms reported what they expected oil and natural gas prices to be in six months, one year, two years, and five years. The average expected WTI prices were $75, $79, $83, and $88 per barrel, respectively. The average expected Henry Hub natural gas prices were $3.00, $3.33, $3.71, and $3.98 per million Btu, respectively.

Contacts were also asked how tighter credit conditions since February 2023 have affected their firms and will affect their business plans in the future (Chart 4). 66% of firms reported that the tighter conditions have had no negative impact, 28% reported they have had a slight impact, and 6% reported a significant impact. Additionally, 52% of firms reported that tighter credit conditions will have no negative impact on their business plans, while 36% reported they will have a slight impact and 12% said they would have a significant impact.

Chart 4. Special Question - How have/will tighter credit conditions since February 2023 had/have an impact on your firm and business plans?

Skip to data visualization table| Response | Had impact so far | Will impact business plans |

|---|---|---|

| No Impact | 66.00 | 52 |

| Slight Impact | 28.00 | 36 |

| Significant Impact | 6.00 | 12 |

District energy firms were also asked how global consumption has compared so far this year with their expectations before China announced its reopening in December 2022 (Chart 5). While no contacts reported that global oil consumption has significantly overperformed expectations, 7% said it slightly overperformed expectations, 33% reported it met expectations, 53% reported it slightly overperformed, and 7% reported significant underperformance.

Chart 5. Special Question - How has global oil consumption so far this year compared with what you expected before China announced its reopening in December 2022?

Skip to data visualization table| Response | Percent |

|---|---|

| Significantly Overperformed | 0.00 |

| Slightly Overperformed | 6.67 |

| Met Expectations | 33.33 |

| Slightly Underperformed | 53.33 |

| Significantly Underperformed | 6.67 |

Selected Energy Comments

“Current low inventory levels leading to strength in 6-month time frame, demand slowing and longer term supply increasing over the 2-5 year time frame.”

“Gas seen as longer-term pillar in energy transition. Still lots of known supply available.”

“I expected higher demand coming from the China re-opening. Currently it does not look like that demand is there.”

“Our company could do more and would do more if we could find quality people. The traders have believed the recession talk and have hurt commodity prices. The fundamentals still show energy use increasing. Oil and gas are a big part of filling that need.”

“Our experience is that AI will augment personnel, not replace. Perhaps in a time frame longer than five years you might have some moderate replacement of personnel.”