The farm economy in Oklahoma generally has remained solid but has diverged negatively from surrounding states in the Federal Reserve’s Tenth District._ One reason for this divergence has been the state’s concentration in industries that have faced more pressure than others. Oklahoma is particularly concentrated in cattle and wheat and less so in corn and soybeans than neighboring states. Corn and soybeans have typically generated larger revenues and profit margins than wheat. Also, profitability in the cattle sector has been slow to recover from the pandemic, limiting Oklahoma’s ability to keep pace with the surrounding region. Moreover, drought has disproportionately affected large portions of the state, reducing production potential for wheat and putting additional inflationary pressure on feed costs for cattle producers.

Oklahoma’s Farm Economy and a Growing Divide with the Neighboring Region

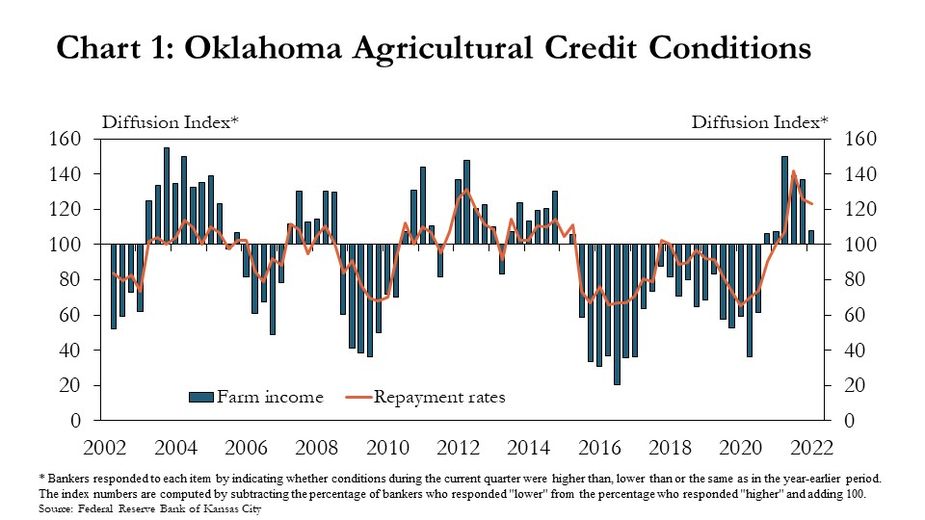

Agricultural credit conditions in Oklahoma remained solid but softened somewhat in the first quarter of 2022. Following a strong rebound in the Oklahoma agricultural economy in 2021, farm income growth was limited in the first quarter of this year (Chart 1). In addition, improvements in farm loan repayment rates continued to slow after accelerating rapidly in the third quarter of 2021. However, the latest index for repayment rates was still the fifth highest since 2002, suggesting that farm liquidity remained strong entering 2022.

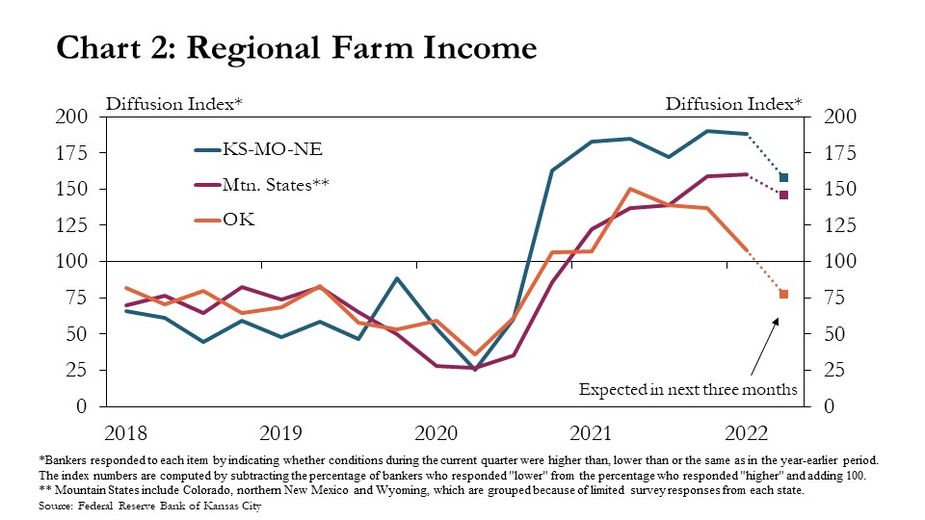

Despite general strength overall, the outlook for the Oklahoma ag economy has diverged somewhat from other states in the Tenth District. In the first quarter, only 23% of bankers in Oklahoma expected an increase in farm income in the next three months, while almost 50% expected a decline. Expectations for farm income softened slightly in other states as well (Chart 2). However, in contrast to Oklahoma, about 67% of bankers in Kansas, Missouri and Nebraska and more than 55% of bankers in the Mountain States of Colorado, New Mexico and Wyoming expected an increase in farm income in coming months.

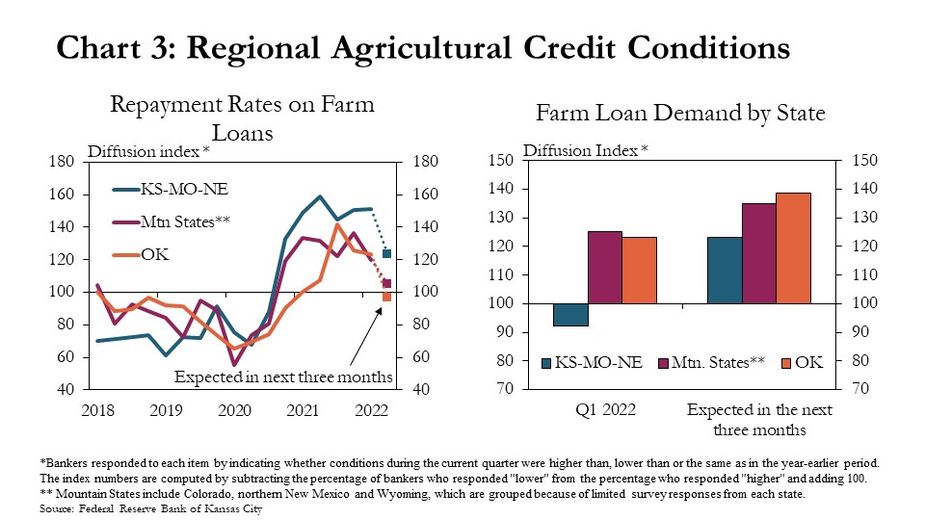

Agricultural credit conditions also were expected to deteriorate a bit more in Oklahoma than in other states. Repayment rates were expected to weaken in coming months across all regions of the Tenth District, but Oklahoma was the only state where a larger share of bankers expected repayment rates to be lower than a year ago (Chart 3). In addition, demand for credit remained elevated in Oklahoma in 2021 and was expected to continue to increase at a faster pace than in surrounding states in the second quarter of 2022. Although farm liquidity had strengthened coming into 2022, External Linkhigher production expenses may have begun to put more pressure on farm income, elevating farm borrower financing needs (Cowley, Rodziewicz and Cook 2022).

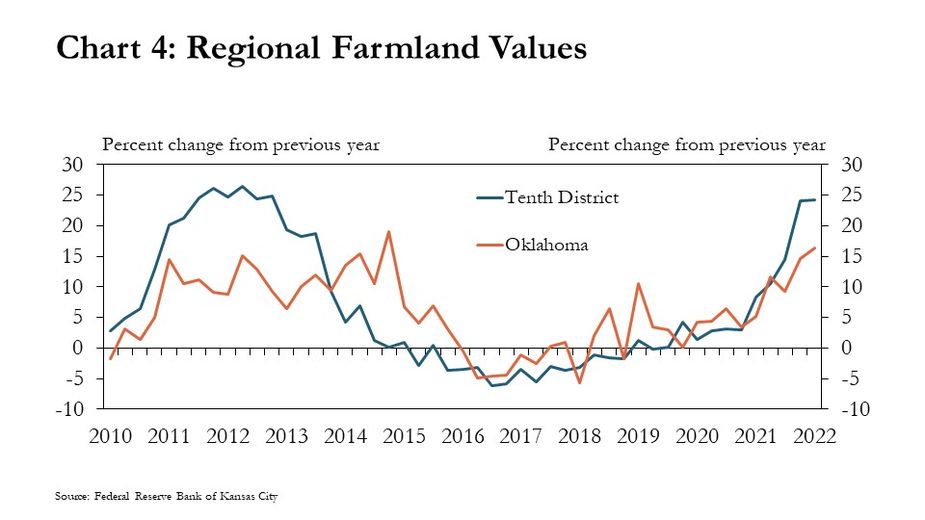

Growth in Oklahoma farm real estate markets has remained strong but also has lagged surrounding states. From 2016 to the second quarter of 2021, the gains in Oklahoma farmland values either matched or exceeded the rest of the region (Chart 4). Since 2021, however, farmland values in the Tenth District have increased more than 24%. Although farm real estate values in Oklahoma also have grown at the fastest pace since 2014, the annual growth rate of 16% still lagged the district in the first quarter of 2022.

Factors Driving a Weaker Outlook in Oklahoma

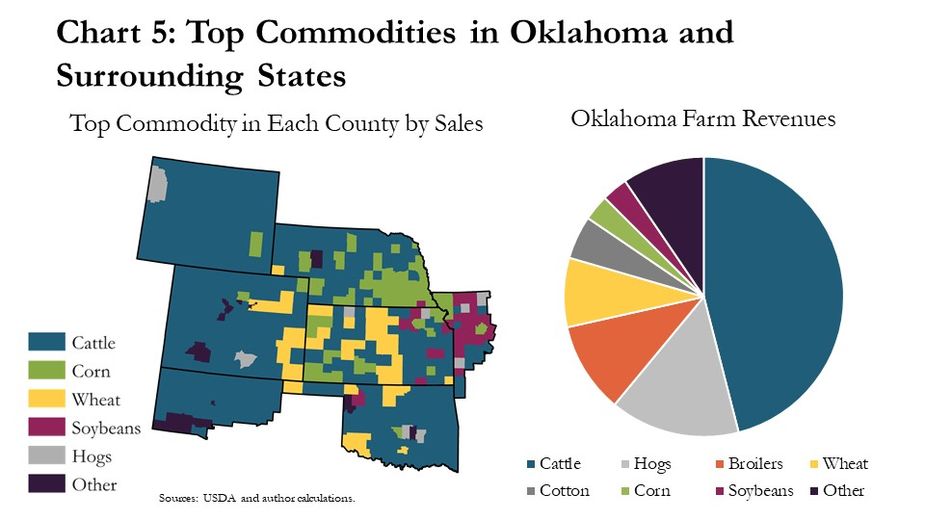

Oklahoma’s agriculture sector depends heavily on economic conditions in the cattle and wheat industries. Most counties in Oklahoma typically have generated a majority of their farm revenues from the production of cattle, but wheat production has supported farm revenues in several western counties (Chart 5). In contrast, corn and soybeans have been more prominent in Kansas, Missouri and Nebraska and have comprised a larger share of farm revenues in those states. In Oklahoma, the production of livestock and wheat has accounted for almost 80% of farm revenues, while corn and soybeans have accounted for only 6%.

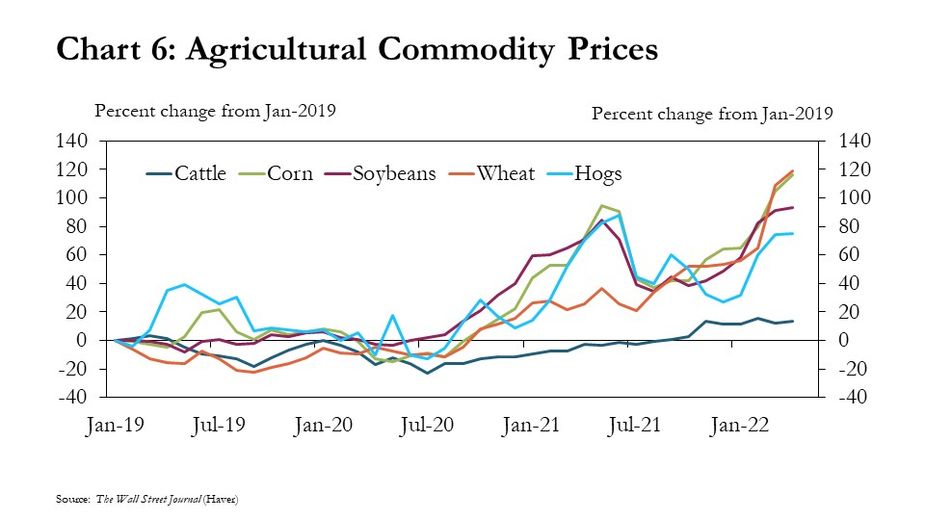

With less production of corn and soybeans, the Oklahoma farm economy has not benefited as much in recent years as other states from higher prices for these crops. Prices for most major agricultural commodities rose sharply beginning in the second half of 2020 as economies around the world recovered from the pandemic and global demand surged (Chart 6). External LinkCattle prices have been slower to recover, however, and price increases for wheat stalled in the first half of 2021 (Cowley 2021). In mid-2021, prices for corn, soybeans and hogs all rose more than 80%, while the maximum price increase for wheat was just over 50% later in the year.

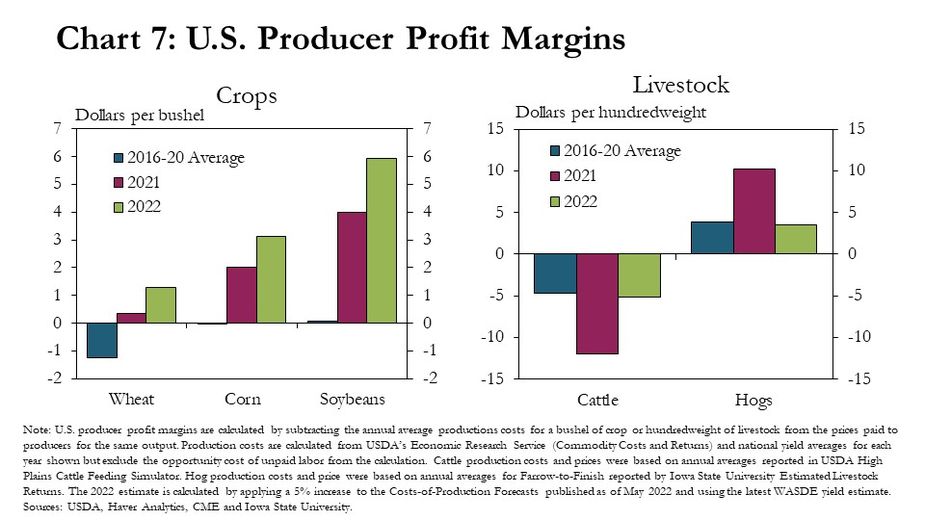

More recently, prices for wheat have risen sharply External Linkfollowing widespread global disruptions related to the war in Ukraine, but wheat and cattle production still have not been as profitable as other crops or livestock (Cowley, Rodziewicz and Cook 2022). Profit margins for wheat have been positive in 2021 and 2022, but profits for corn and soybeans have been larger (Chart 7). For example, on average, profit margins for wheat have been about $1.30 a bushel nationally, while margins for corn and soybeans were $3.00 a bushel and almost $6.00 a bushel, respectively. Higher margins for corn and soybeans likely led to a more optimistic outlook in states concentrated in these crops. In addition, margins for cattle have been weak in the aftermath of the pandemic. Although margins for hogs remained positive, weaker profitability for cattle has likely contributed to a dampened outlook in Oklahoma.

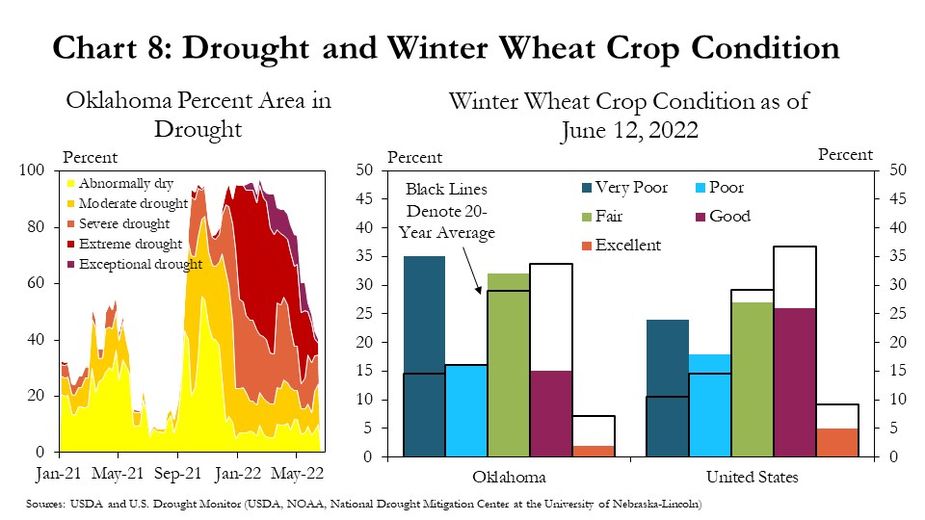

Severe drought this year also has disproportionately impacted Oklahoma by constraining its wheat crop. For most of the growing season for winter wheat, a large share of the state of Oklahoma was in some level of drought (Chart 8). Furthermore, the western half of Oklahoma, which has a majority of the state’s cropland, was in severe to exceptional drought. Due, in large part, to drought-induced stress, about 51% of the state’s winter wheat crop was in poor or very poor condition entering harvest season. More wheat was in very poor condition compared with both the broader U.S. and historical norms for Oklahoma. In addition, considerably less wheat in the state was in good or excellent condition compared with the nation and with the 20-year average for Oklahoma.

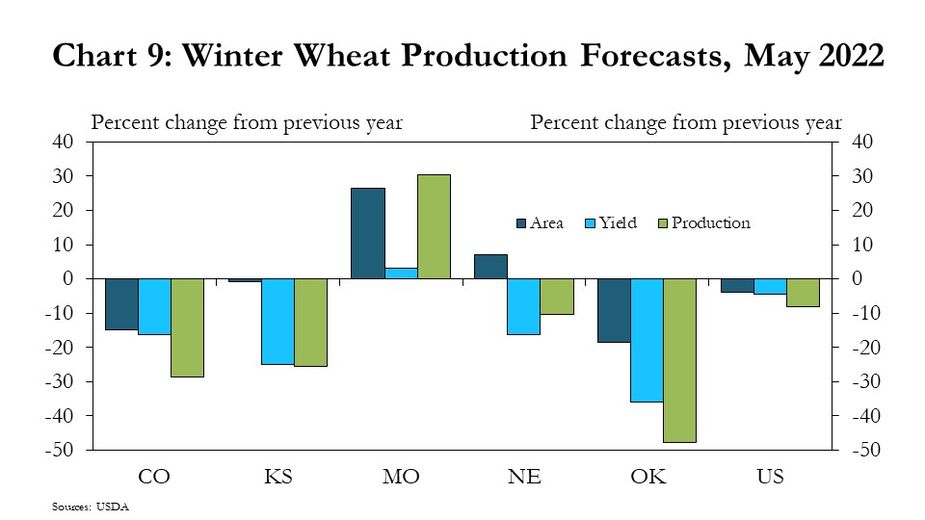

Amid adverse weather conditions, wheat production in Oklahoma was expected to decline, which may limit the ability of producers to take advantage of higher prices. In May, winter wheat production in Oklahoma was projected to be 50% less in 2022 compared with 2021 (Chart 9). Although a reduction in the number of acres planted contributed to the lower production forecast, an expectation of lower yields was the primary driver. All Tenth District states, except Missouri, have experienced some level of drought during the winter wheat season and are expected to produce less wheat in 2022. However, the production forecast in Oklahoma was notably lower compared with other states and the U.S. average. External LinkAccording to one ag banker in the Oklahoma Panhandle, drought has hampered the ability of Oklahoma wheat producers to “participate in high grain prices” (Kauffman and Kreitman 2022).

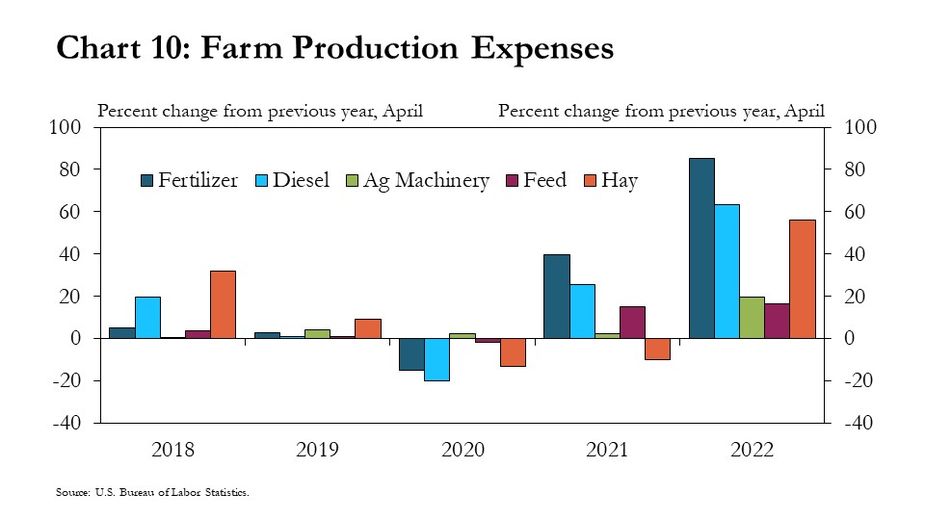

In the cattle sector, drought also has put substantial upward price pressure on hay, a key input for cattle, further dampening the outlook for cattle producers amid broader increases in production expenses. Hay prices rose sharply early in 2022 and, in April, were 56% higher than in 2021 (Chart 10). Feed costs, which make up a large share of livestock production expenses, increased more than 15% year over year in both April 2021 and April 2022. In addition to higher feed costs, sharp increases in fertilizer, diesel and ag machinery have likely put more downward pressure on the outlook in Oklahoma due to the relative importance of the cattle industry in the state’s agricultural sector.

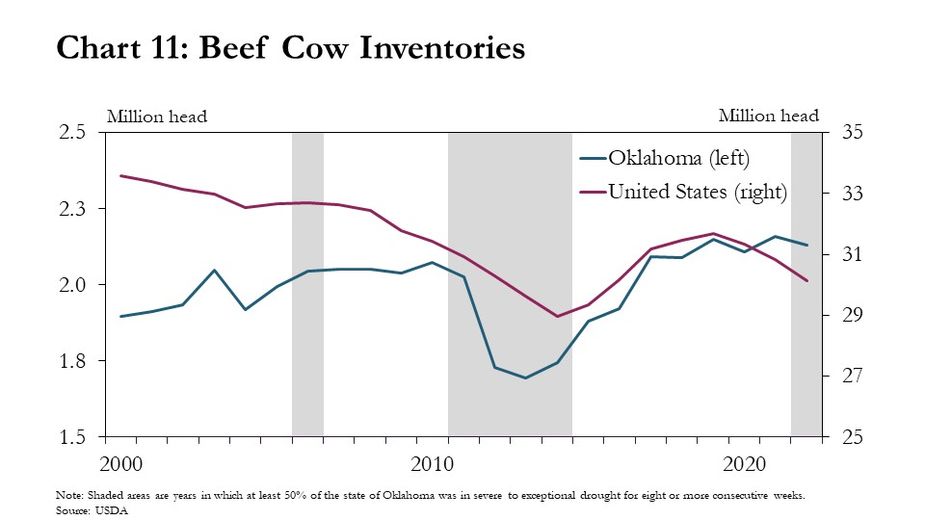

Drought also may have contributed to some herd liquidation in the state. Chart 11 shows the cattle herd in Oklahoma tends to decline during intense drought. More recently, amid drought and higher production expenses, External Linkthe cattle herd in Oklahoma declined 100,000 head (or 2%), while the beef cow herd declined 28,000 head (or 1.3%) as of January 2022 (USDA 2022a). Also, U.S. farmers continued to send record numbers of cattle to feed lots in External LinkApril and External LinkMay, which may indicate that inventories have tightened further (USDA 2022b, 2022c). Finally, extreme heat, one component of drought, has contributed to External Linkreports of death loss on farms and at feedlots this year (Myers 2022). Although smaller herd sizes may help Oklahoma farmers manage costs in the near term, they limit prospects for future returns.

Conclusion

Although the agricultural economy in Oklahoma has remained solid, expectations for farm income and agricultural credit conditions have softened more than in other states, particularly in wheat- and cattle-producing areas affected by extreme drought. The state received more rain in recent weeks, which may improve prospects for cattle, corn and soybean production but was too late to benefit the wheat crop. Also, some areas with the highest need for precipitation remained dry. As of the second week in June, more than 40% of the state was still in some level of drought. Moving forward, severe drought and higher production expenses may continue to disproportionately dampen the outlook in Oklahoma compared with other states in the region.

References

Cowley, Cortney. 2021. “Long-Term Pressures and Prospects for the U.S. Cattle Industry.” Federal Reserve Bank of Kansas City, Economic Review, vol. 107, no. 1.

Cowley, Cortney, David Rodziewicz and Thomas R. Cook. 2022. “Turmoil in Commodity Markets Following Russia’s Invasion of Ukraine.” Federal Reserve Banks of Kansas City. May 23.

Kauffman, Nate, and Ty Kreitman. 2022. “Credit Conditions Remain Strong, but Outlook Softens.” Federal Reserve Bank of Kansas City, Ag Credit Survey, May 12.

Myers, Victoria G. 2022. “Thousands of Cattle Reported Dead: Heat Stress Kills Estimated 10,000 Head of Kansas Feedlot Cattle.” Progressive Farmer (DTN). June 14.

U.S. Department of Agriculture. 2022a. “January 1 Cattle Inventory Down 2 Percent.” National Agricultural Statistics Service, Cattle Inventory Report, January 31.

U.S. Department of Agriculture. 2022b. “United States Cattle on Feed Up 2 Percent.” National Agricultural Statistics Service, Cattle on Feed Report, April 22.

U.S. Department of Agriculture. 2022c. “United States Cattle on Feed Up 2 Percent.” National Agricultural Statistics Service, Cattle on Feed Report, May 20.

Endnotes

-

1

The Tenth District includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri. Also referred to as “the Tenth District.”